They’ve toured halls, classrooms and “cafegymatoriums,” and now they’re in the weeds.

Task force members commissioned by the Springfield Public Schools board have visited all but one of the 10 schools in need of renovations (or outright replacements). Some local school buildings are in a pitiful state, with cracked floors, cramped hallways and little space for expansion.

But before renovations can begin, the task force needs to decide how to pay for them. The decision will influence property tax rates down the road.

In recent meetings, the members have taken a crash course on the process of issuing a school bond, as well as current and projected economic trends that could affect what is put before voters in April 2023.

If the task force recommended a general obligation bond vote based on the current tax rate, that could lead to a $220 million ask of voters next year to improve or replace school buildings across the district. Bigger and smaller asks have been put on the table for discussion as well.

What they decide to put on the ballot will affect taxes, but it won’t make a difference on your property tax statement anytime soon. In 2019, voters approved an 18-cent increase over two years to the district’s debt-service levy. The debt service levy now stands at 73 cents, and SPS projects that to remain in place for another 18 years. If another bond issue is put before voters in April, the levy would be extended four or five years beyond 2040.

Money already at work

That 2019 vote approved $168 million in funds for the school district, and much of it has been put to work improving facilities.

It financed an early childhood center next to Carver Middle School, new Delaware and Boyd Elementary schools, renovations at Sunshine and Williams Elementary and the construction of a new Jarrett Middle School.

The bond also allotted nearly $8 million to install secured entrances at 31 schools. Enough of those projects came in under budget that it freed up funds to address some, but not all, of the projects the 2018 task force had outlined for a second phase, including renovations to Hillcrest High School and a new York Elementary.

How does a debt-service levy work?

Voters in 2019 approved an increase in the Springfield Public School District tax levy to fund infrastructure improvements across the district. The levy now stands at 73 cents, and it’s applied to every $100 of assessed property value in the district. Property is taxed at different rates depending on the type. At a recent meeting, John Mulford, SPS deputy superintendent, provided this example to show how that levy currently impacts a taxpayer with a $200,000 home and a $25,000 car:

Personal home assessed at $200,000 x 19 percent tax rate = $38,000 assessed value

Personal vehicle assessed at $25,000 x 33.33 percent tax rate = $8,333 assessed value

Total assessed value = $46,333

Divided by 100 = $463.33

Multiplied by $.73 debt service levy = $338.23 annual tax, or $28.19 per month

(The levy also comes into play with commercial and agricultural property. Missouri’s commercial property tax rate is 32 percent, and the agricultural property tax rate is 12 percent.)

Options could provide between $450M-$630M in infrastructure improvement over three phases

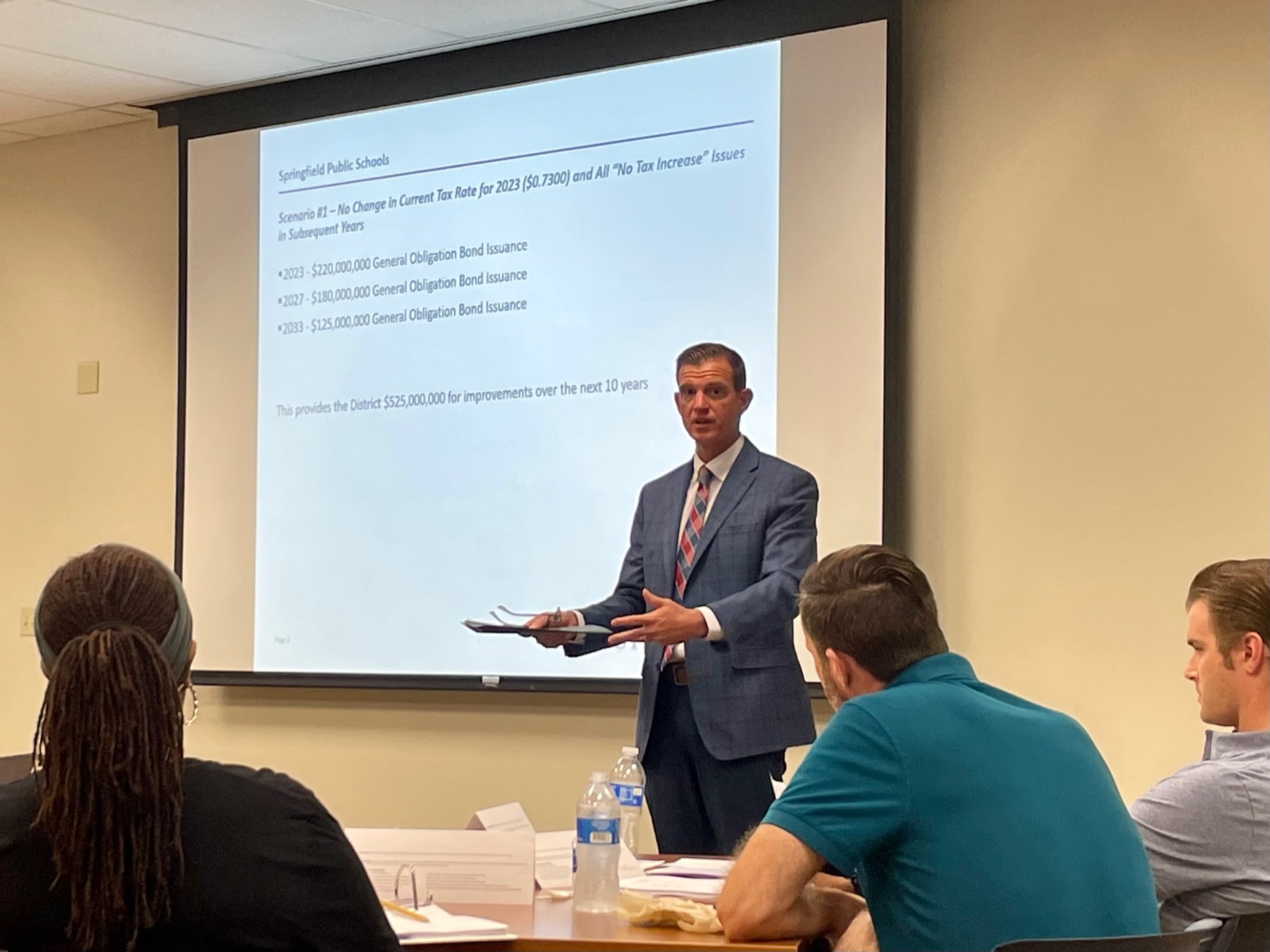

On Tuesday, Brent Blevins, Springfield-based managing director of public finance brokerage firm Stifel, presented three scenarios based on maintaining, increasing or decreasing the debt-levy service tax rate that could be put before voters next spring and then again four and eight years after. In 2023, the scenarios look like this:

Scenario No. 1: A $220 million bond issue if there were no change to the current tax rate

Scenario No. 2: A $240 million bond issue if the rate were increased 6 cents

Scenario No. 3: A $185 million bond issue if the school board voted to decrease the rate by 6 cents

“We've got a conservative estimate on your growth,” Blevins said. “We've got a conservative estimate on your interest rate. And we've got a conservative estimate on how we're going to structure these bonds. So we feel very, very comfortable with the $220 million.”

Blevins said he would not recommend a decreased rate, both because it could impact current debt repayments and because he said the district is in good shape to put forward a bond issue, even in the midst of increasing interest rates and inflation. The district has an AA credit rating from Standard & Poor’s, and has not maxed out what he described as either of its two credit cards.

By state statute, the district can borrow up to 15 percent of the district’s assessed property valuation and state-assessed railroads and utilities. The railroad and utility assessment adds up to about $16 million. The assessed valuation is tagged at just over $4.1 billion. In total, the district is allowed to borrow nearly $622 million. As of June 30, it has $310 million in debt, and $17 million in the debt service checking account. That means the district could ask voters for up to nearly $329 million in 2023, according to data provided in August to the group by the district. None of the numbers on the table are that high.

“Your constitutional body capacity is 15 percent of your assessed value,” Blevins said. “Your ‘what I can afford' capacity is what you can afford based on your 73-cent levy. A lot of districts — even around here in the metro — are up against their constitutional body capacity. They have a debt-service levy that actually could afford to run more no-tax-increase bond issues, but they're up against their 15 percent constitutional body capacity and can't. Springfield's in a much different situation.”

The scenarios each factor in additional bond issues in 2027 and 2033, which would lead to $630 million (scenario No. 2), $525 million (scenario No. 1) or $450 million (scenario No. 3) in funding for facility improvements over the next decade.

Missouri constitution's statute on school bonds (Click to expand story)

Missouri statute caps how much money a district is allowed to ask its voters to borrow — “an amount not to exceed 15 percent of the value of such taxable tangible property.” The vote must be approved by four-sevenths of voters on municipal, primary or general election days and two-thirds during other election days. Because a school district must pay its county clerk’s office for election services during a cycle where a district issue is in play, that’s why you almost always see bond issues up for a vote at the same time as school board candidates are on the ballot. The district gets more bang for its buck.

Million-dollar question

David Hall, co-chair of the task force, asked presenter Matt Morrow what he described as the “million-dollar question” that the group has to answer. Is this the time to ask taxpayers to vote on a big-ticket project?

Morrow, executive director of the Springfield Area Chamber of Commerce, answered first with a question he’s been getting a lot lately: Are we in a recession? His answer to that was a mixed one. His traditional definition of a recession, he said, is two consecutive quarters of negative gross domestic product. That’s happened, he said, and he said he doesn’t have an answer to whether inflation gets under control in short order. Interest rates aren’t historically high, he said, but they’re higher than what they recently were, which matters to people.

But, he said, there’s “virtually no chance” there will be high joblessness in the area anytime soon, meaning anything resembling a recession won’t resemble the kinds of recessions seen before it.

Morrow had a more straightforward answer to a question about the importance of a thriving school district in attracting new businesses and residents.

“I will just say that a robust and strong public education system in the community is absolutely, absolutely critical to business growth,” Morrow said. “It's the main pipeline for future workforce. Not only that, it's seen as kind of a barometer for the health of the community in many cases. And so, (it’s) really, really important to get right.”

The task force will continue to meet through at least early October as they advance toward a consensus recommendation to present to the school board.