In the midst of concerns of a late 2023 recession, sales and use tax revenues in Springfield remain strong, well above budget projections and actual revenues of the previous fiscal year.

While the city’s financial officers anticipate continued growth in sales tax revenue in the recent adoption of the city budget, staff is cognizant of a potential recession, and the impact it could have on operating revenues.

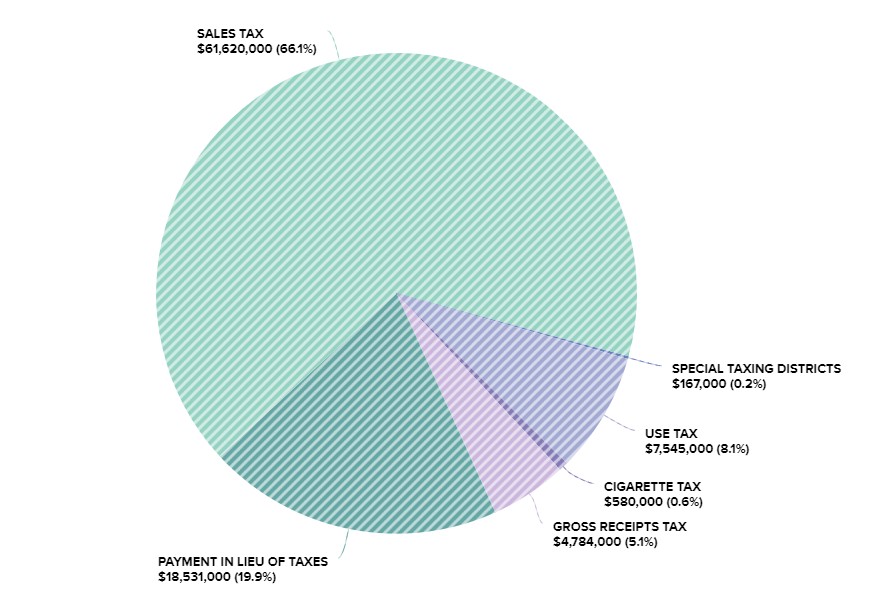

Springfield has long been heavily reliant on sales and use tax revenue, with it typically making up approximately 62 percent of the city’s general fund.

“We do anticipate to return to normal,” said Teresa Allen, the budget coordinator for the city’s Finance Department. “I can't imagine double digit growth for eternity.”

Budget projects slowed growth sales tax revenue

For much of the city’s last fiscal year, which runs from July 1, 2022, to June 30, 2023, sales tax revenue has hovered around 10 percent above budget. That growth peaked in August at 16 percent above budget and took a slight dip in September at less than half of a percent below budget. June sales tax revenues, which actually reflect transactions primarily made in April, are up over 9 percent at $4,291,817.

The June report also shows actual revenues are up nearly 12 percent compared to the budget, and more than 5 percent compared to actuals on a year-to-date basis.

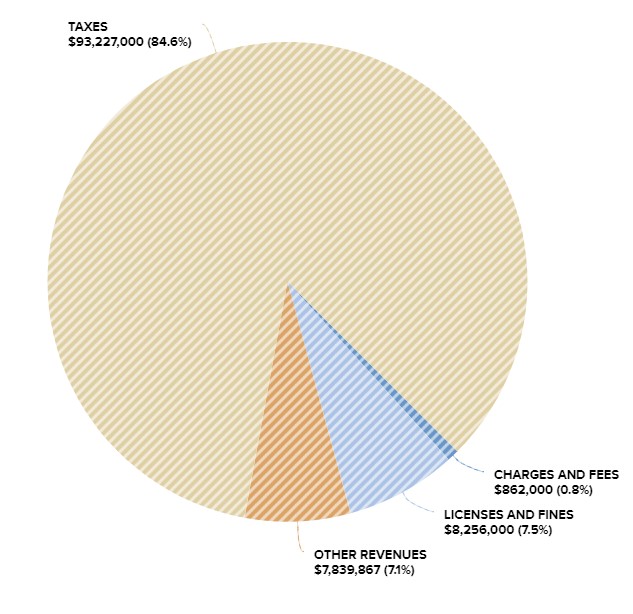

Of the city’s $495,690,888 budget for the upcoming fiscal year, sales and use tax makes up more than 36 percent of it, at nearly $181 million. The general fund, which funds police, fire, public works, building and development services and planning and development, among other departments, makes up more than $110 million of the total budget. The general fund is even more reliant than the overall budget on sales and use tax revenues, with it making up 62.8 percent, more than $69 million, of the fund.

Even in periods of decline, sales tax revenues in the last 40 years are typically modest, averaging 3-4 percent, according to City Manager Jason Gage’s budget message to the Springfield City Council.

As a result of the revenue gains the city has experienced in recent years, the newly adopted budget estimates a continued, albeit slowed growth in sales tax revenues over the next fiscal year, with a projected 2-percent increase over the projected year-end.

“We do hope things get back to normal without landing too hard,” Allen said.

Elasticity of sales tax beneficial, problematic for Springfield

While Springfield’s reliance on sales tax revenue can be beneficial during positive economic growth years, it makes the city uniquely vulnerable to economic downturn. This was illustrated during the Great Recession, which had a “significant” impact on the city’s budget.

“It was severe, and it was pretty immediate when the recession happened…it was very challenging,” Allen said.

Sales tax revenue is contingent on several factors, including inflation, interest rates, energy prices, consumer debt and geopolitical uncertainty. The city’s status as an economic center and college town also plays a role in the high level of sales tax revenue per capita, according to the budget message.

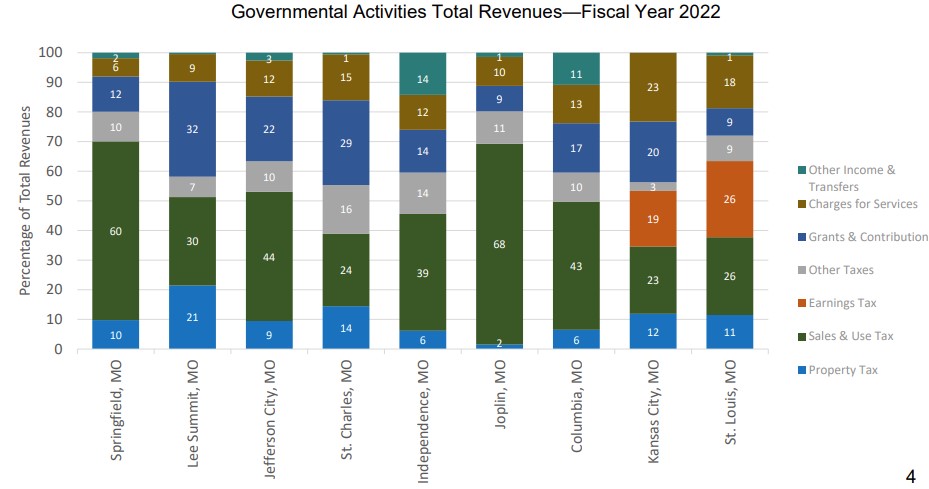

While it has been beneficial in recent months, Springfield’s over-reliance on sales and use tax, which made up 60 percent of total revenues in FY 2022 could create “significant financial challenges” for the city in a recession, which many economists are still anticipating.

Among Missouri’s largest cities, Springfield is the second most reliant on sales and use tax, with sales tax only making up more of Joplin’s total revenue at 68 percent. In Kansas City and St. Louis, sales and use tax make up only 23 percent and 26 percent of the respective budgets. Unlike Springfield and Joplin, Kansas City and St. Louis both collect earning taxes.

In his budget message, Gage acknowledges the “city needs to identify approaches to better diversify our revenue sources to minimize this up and down effect.”

Due to the city’s continued growth in sales tax revenue, consciousness of economic forecasts and continuing to “live within its means,” Springfield has been able to prepare for a possible recession.

Despite economic resiliency, recession concerns persist

Economists have anticipated a 2023 recession for some time now, but a downturn has yet to materialize. While many financial institutions have predicted a lessened likelihood of a recession in the next 12 months, concerns persist.

As economists at Goldman Sachs list the chance of a recession in the next year at 25 percent, probability predictions are higher elsewhere.

While Jeff Jones, the department head of Finance and Risk Management at Missouri State University, is uncertain on the timeline of a recession, he still anticipates one to occur in years ahead.

“I thought 2023 was going to be kind of a rough year, but it really hasn't panned out that way,” Jones said.

With the exception of the COVID-19 pandemic, from which Jones said people underestimated how quickly the economy would recover, he suggested that the United States may be due for a slowdown due to a long streak of non-recessionary years.

“If we don't have something that meets the technical definition of a recession within the next five years, I’d be very surprised,” Jones said.

The City of Springfield’s monitoring of signs of a recession are reflected in its revenue projections for the fiscal year that starts July 1, especially due to its over-reliance on sales and use tax revenue.

“I think, hopefully, we're poised to take somewhat of a hit,” Allen said. “Because certainly, (a recession) does seem like it has to come at some point, but we are certainly cognizant of that.”