To kick off tax season, Greene County officials remind residents and property owners of their deadlines, responsibilities, different ways to pay and how to access resources.

Greene County Collector of Revenue Allen Icet urged that outstanding assessments be submitted and personal property and real estate taxes be paid in a timely manner to avoid penalties and fees, for which Missouri laws grant no wiggle room.

“There are no mulligans, it does not matter,” Icet said at a Nov. 1 press conference. “If you're late, you're late so please don't do that, I don't like having those conversations.”

Collector’s office debuts new way to pay, but prefers online method

Personal property and real estate tax statements became available for review and payment on Nov. 1. Currently accessible online, paper copies will start being mailed out in a couple of weeks, according to Icet, and email reminders will be sent to anyone whose email is on file with the county.

Icet emphasized that even if someone doesn’t receive a statement, which could be a result of potential errors in the mailing of some-150,000 of them, it is still their responsibility to pay their taxes on time.

“Some people unfortunately believe if you don’t — if I don't receive a tax statement, I therefore do not owe the bill,” Icet said. “That is not correct. Even if you don't receive your statement, by statute, you are still liable to pay, so please reach out to the Collector's Office to find out what the bill is if for some reason you did not receive a bill; and that happens.”

Anyone who didn’t receive a mailed statement or email can contact the Collector’s Office via email at collectorhelp@greenecountymo.gov.

While Icet still strongly encourages people to pay online, the Greene County Collector’s Office is debuting a new payment method this year: payment over the phone. Greene County taxpayers can pay-by-phone by calling 888-523-0054.

A tax ID is required to pay online or over the phone, with a pin number also needed in order to pay online. Both can be found near the top left corner of the page of a tax statement.

Personal property and real estate taxes can also be paid in-person or by mail, though Icet noted that the collector’s offices would close on Dec. 29 and wouldn’t reopen until after Jan. 1. In addition, mailed payments must have a 2023 U.S. postmark, and with the deadline falling on a Sunday — when post offices will be closed — it could be considered late if mailed at the last minute.

“State statute is black and white, it’s the 31st,” Icet said. “It doesn't matter what day of the week, if it's a holiday, it does not matter.”

A 9-percent penalty and 2-percent interest will be charged to late tax payments.

Late assessments don't prevent penalties

A mail mishap is not the only reason someone may have not received a statement. Statements are only issued to people who filled out their personal property assessment, which was due on March 1. You can check your assessment status on the Greene County Assessor’s website, or reach out by email at assessoronline@greenecountymo.gov.

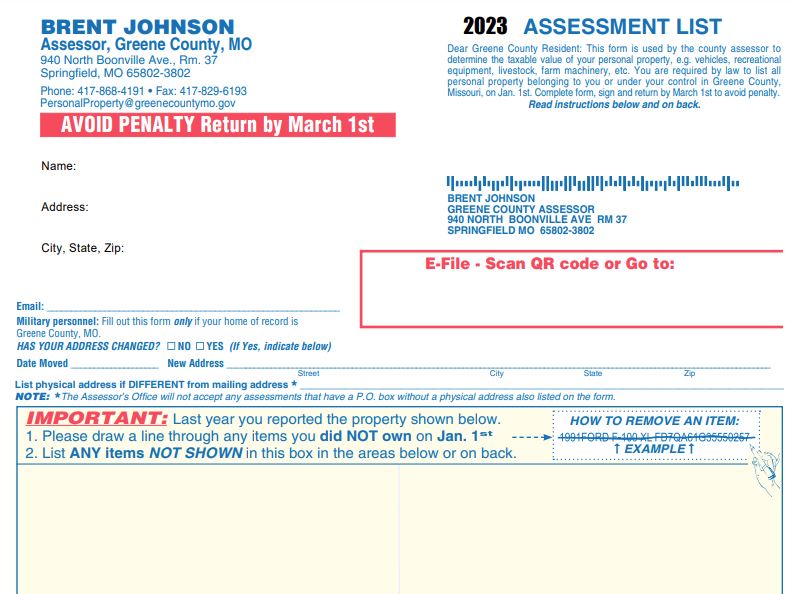

Greene County Assessor Brent Johnson said there are still about 17,000 property owners who have not returned their 2023 assessment lists.

“Go ahead and get that filled out because your late assessment penalty is a lot less than being stacked with a late assessment penalty and late tax penalty,” Johnson said. “So you're still required to pay those taxes even though they didn't get your assessment turned in.”

SB 190 not yet in effect, vehicle values dip

While the state statute that determines vehicle valuations — through the National Automobile Dealers Association — hasn’t changed, Johnson said that the values did go down this year, and it will be reflected on vehicles’ assessed values and taxes.

Though the deadline has passed to contest real estate assessments, people can still call the Greene County Assessor’s Office if they want to appeal the assessed value of their vehicle.

Lastly, Icet noted that the property tax freeze for seniors that is being implemented in Greene County following the passage of Senate Bill 190 earlier this year would not be reflected in the upcoming tax statements, as it doesn’t become effective until Jan. 1, 2024.

He hopes to have more answers as to how eligible seniors can apply for the tax credit early next year if the state legislature heeds a resolution from of a Missouri Association of Counties (MAC) to address issues with the legislation. The current language of the law has wrought confusion around its lack of clarity. Icet said a task force that he sits on submitted its recommendations for that resolution to the MAC president on Nov. 1.

“We've had people in the office to pay and they've already asked ‘How do I get my credit?'” Icet said. “Again, the key point is that this does not become effective in Greene County until January 1, 2024.”

Once effective, Icet is hopeful the legislature will quickly pass a bill and to give “a little bit better roadmap on how to implement” SB 190.

More information on how the tax process works can be found on the Greene County Collector’s website.

The Greene County Collector's Office and Assessor's Office are located in room 109 and 107, respectively, of the Greene County Historic Courthouse, located at 940 N. Boonville Ave. in Springfield. Both offices are open from 8 a.m. to 4:30 p.m. Monday through Friday.