IN-DEPTH

Though difficult decisions await, a previously “dire” outlook for Greene County’s 2024 budget has improved. Additional revenues, savings and sales tax projections have mapped out a way forward.

The Greene County Commission is set to weigh spending requests from county officeholders and departments against the Budget Office’s recommendations, which were presented on Nov. 15, before the commission adopts a final budget on Jan. 10, 2024.

Since budget requests were made in September, a few changes have been made that are expected to provide the county with more cash than previously anticipated. The recommended general revenue budget contains $85.9 million in expenses in 2024.

With declining growth in sales tax revenues and increased budget requests over the previous fiscal year — which runs on a calendar year — commissioners have tough decisions to “identify best choices out of all of the many needs.”

“We know it's going to be a difficult year, but we can get through it,” Presiding Commissioner Bob Dixon reassured officeholders, department heads and other county staff members at the Nov. 15 meeting.

Recommendations more than $16 million short of requests

Greene County’s operations and services are backed by different funds, with each fund supported through taxes, fees and other forms of revenue. The Law Enforcement Sales Tax and General Revenue funds are among the largest and most diverse, in terms of how their revenues are budgeted, and primarily subject to the commission’s discretion.

Overall, county offices and departments are requesting a total of $16,651,673 more out of the Law Enforcement Sales Tax and General Revenue funds than what the Budget Office recommends for 2024.

These funding requests are derived from reasons including inflation, a cost of living adjustment for county government employees, contracts previously awarded by the commission and anticipated election costs.

For example, while the recommended budget includes a significant increase to the Greene County clerk’s 2024 budget, it is still well short of County Clerk Shane Schoeller's request.

“This was based on just our analysis of the last presidential election,” Scott said. “We are aware that there have been several changes, like the rate of pay for judges. So I believe when the clerk's office comes and makes their request at the budget hearing, there’s some very good reasons for a lot of these numbers to be added back in.”

Elsewhere, the recommended budget for the Greene County Sheriff’s Office came in well below ($6.4 million) what was requested from General Revenue, though it still provides for an increase over 2023.

The county commission’s overall budget is comprised of expenses for the commission itself, 16 departments and other expenses, and is more of a mixed bag in terms of funding requests made and proposed cuts.

It is typical for the recommended budget to shave off some amount of requested funding, though it also removes a cost of living adjustment (COLA) for county employees and includes funds that will be realized when vacant jobs go unfilled.

The recommended budget of each office and department can be contested in a series of public hearings held near the end of November. Commissioners will then balance budget requests — and explanations justifying those requests — with the recommendations of the Greene County Budget Office.

Afterwards, the budget office staff will draft a final budget based on those decisions, and the 2024 budget will be up for final adoption in early January.

Sales tax growth expected to get worse before it gets better

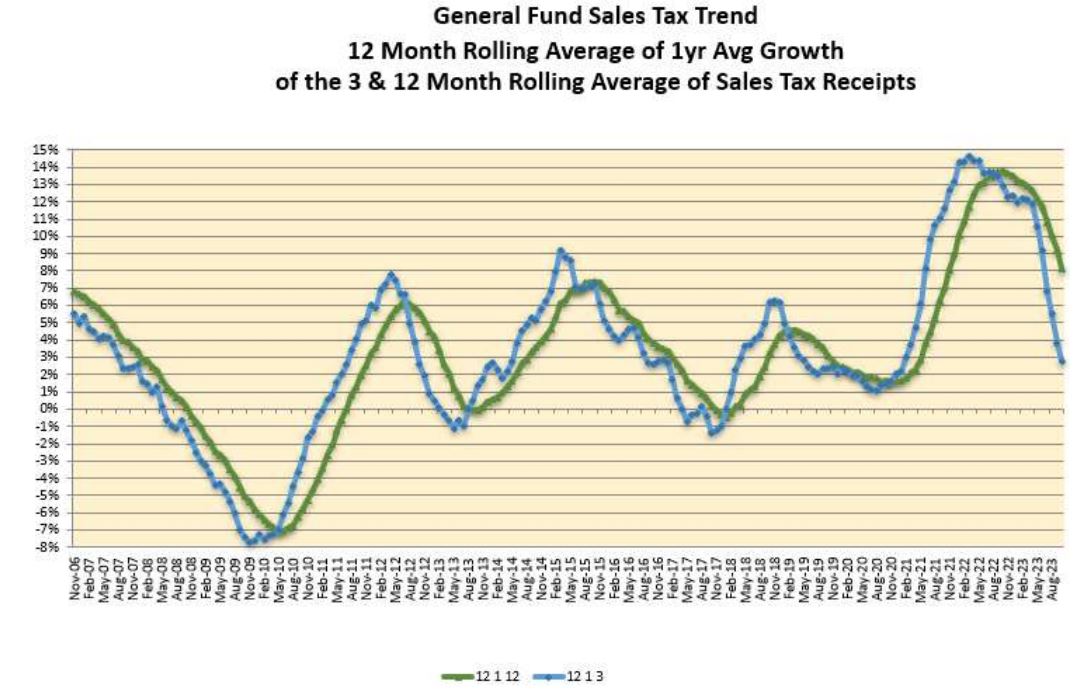

While the county’s General Fund Sales Tax growth rate has remained high for much of 2023, it began decreasing in late 2022, a decline that has gained speed in recent months. Scott anticipates the decline to continue, culminating in a potentially brief period of negative growth in early 2024.

“We are anticipating that our sales tax, instead of being higher than anticipated at the end of this year, is going to be lower than anticipated,” Budget Officer Jeff Scott said. “And then we also have some disappointments in our planning and building fees, our recording fees and our boarding revenue.”

Those disappointments are expected to amount to about $310,000, or 1 to 2 percent below budget. Sales tax growth peaked in mid-2022, when the three-month and 12-month rolling averages were north of 10% growth. Since then, the three-month trend line has fallen below 5% growth.

This trend is reflected in sales tax revenues for the City of Springfield, which have been below budget in September and October — by 4.11% and 4.49%, respectively — and below the October figures for its previous fiscal year by 2.65%.

However, projections show sales tax growth bouncing back, with an overall 5% increase in 2024 from anticipated 2023 end-of-year figures. This is the first year the Greene County Budget Office is making these projections in order to avoid “punishing the offices and departments and the citizens they serve by not recognizing the most likely volume of revenues that we anticipate having.”

Dixon suggested that much of the 5% growth will likely come as a result of continued inflation, much as he says it has largely contributed to the county’s “explosive growth” in sales tax revenues in recent years.

“Certainly, there are needs out there,” he said. “We're not going to be able to meet all those needs, even with the revenue that we expect to have.”

With that in mind, the commission is approaching the decision-making in “a very careful way” to balance county activities and needs of employees.

“We need to budget carefully and conservatively, which we always do anyway,” Second District Commissioner John C. Russell said. “But I think this year is going to be especially important to do that and focus on the services that the county should be providing the citizens.”

Projected savings, NID bond payoff extended

With sales tax revenues forcing the commissioners to think twice, a limited pool of cash is available to fund a fraction of $16.6 million in funding requests.

Current projections show the county with nearly $31.4 million cash on hand at the end of 2024, though a 20-year plan recommends only about $29 million in reserves. That leaves roughly $2.4 million available to be allocated as needed in the budget, which Scott said is “pretty narrow.”

In terms of maintaining adequate reserves, Scott emphasized that the county is in a “strong financial position” thanks to a 1/2-cent sales tax voters approved in 2017.

“It does give a lot of comfort in knowing we're making projections because it's all projections, and we have a safety net if we've missed a little,” First District Commissioner Rusty MacLachlan said.

To lessen the amount of money transferred out of the General Revenue fund for other expenses, the recommended budget proposes the county pay off a neighborhood improvement district (NID) bond over the next 10 years, rather than set all that money aside for the anticipated payoff in March 2026. This move contributes to a savings of more than $4 million.

Though NIDs are meant to fund public improvements with property tax assessments, the bond was used to refinance the Jamestown NID after Greene County had to use general revenue funds to pay off debts when the project didn’t pan out as anticipated.

Budget boosted by federal boarding revenue

The Greene County Sheriff’s Office, whose labor shortages have contributed to budget problems this year, is looking to bring in additional revenues to the county in 2024 by effectively doubling the number of federal inmates housed at the jail.

Due to a lack of savings on staffing, which was initially projected to help cover nearly $100 million in bond payments on the new $150 million jail over 20 years, the county then turned to federal and state boarding revenue to make up the difference.

In order to justify the size of the jail, Scott said the county relied on the facility housing an average of about 310 federal prisoners a day. In 2022, it averaged 181 federal inmates per day as of November 2022. In recent months, the tally got as low as 107.

“It's been a hit,” Scott acknowledged. “Fortunately, because we've been openly discussing the issues with the requested budget, the sheriff has been able to reach out to the U.S. Marshals Service and they've been developing a relationship where we believe, before the year end, we're going to actually be getting at least 100 extra federal inmates.”

The average daily detention reimbursement for federal inmates was $106 in 2022, according to the U.S. Marshals Service, which Scott estimated could bring in about $3 million in 2024.

“This brings us up to about two thirds of what we thought we were going to have to justify the plan,” Scott said. “But, I mean, having an extra 100 or so federal prisoners and that $3 million makes all the difference in the world to the county in having a dire budget, and a budget that we can work with.”

Dixon said this was possible, in part, due to a change at the federal level that “uniquely” positions Greene County because of the jail’s size and proximity to the Springfield-Branson National Airport.

Scott said additional boarding revenue would outweigh the cost of housing the 100 extra federal inmates. While it wouldn’t add any staffing expenses, other costs associated with housing federal inmates would increase.

Greene County Sheriff Jim Arnott was unavailable for comment on this story.

Cost of living top of mind

Though the many decisions county commissioners face will be deliberate, circumstantial and based on need, a cost of living adjustment (COLA) for county employees has been a priority since the beginning of the budget process.

In order to get a clear idea of its potential impact on the 2024 budget, the commission requested a 5% COLA be built into the requested budget, and remitted from the recommendations.

Each percentage point for cost of living increases would cost the Greene County government $661,853.83, totaling $3,309,269.15 if all eligible employees were awarded a 5% raise at the start of 2024.

For some offices and departments, the increase was the only — or the bulk of — the difference between the amount of money requested and what the Budget Office recommends.

Scott said 5% is “very aggressive,” but it is based on regional inflation indicators. After considering the requests against the recommendations, the commission may adjust the COLA in the final budget based on what kind of increase the county can afford.

“This is the challenge every employer is dealing with right now,” Dixon said. “How do we make up for inflation that's going on across the country, and so [5%] was the goal. And we're juxtaposing that against these requests.”

Vacancies provide opportunity for savings in some areas, cost more in others

In order to save money, some county government department heads are keeping job vacancies vacant, and are closing open positions.

The Greene County Budget Office backed away from hiring someone to start a risk management department, and is shrinking its office “permanently.” Aside from Scott, the only other employee in the department is Deputy Budget Officer Mike Cagle. Greene County Public Information Officer Robert Jehle has also agreed to freeze an open position in his office.

These vacancies and open positions provide savings that can then be allocated elsewhere in the budget. Even so, unintended labor shortages can pain county departments and, in some cases, cost more money than they save.

For example, the Sheriff’s Office spent $873,110 over what it was allocated for staffing vacancies through Nov. 11 to maintain operations at the jail.

“To some degree, you can think that having vacancy can help the budget,” Scott said. “What we've seen, unfortunately, is when you have the vacancies and positions where you have to have the work done, you're paying overtime.”

MacLachlan said the discussions are difficult, but that he appreciated the open and candid nature of the process.

“There will be those that will come in and tell us ‘We just have to do this this year, if there's any way you can make this happen, it's critical,’” MacLachlan said. “We do give higher priority to those needs. And really our department heads and other elected office holders are very honest, and that's all we can ask.”

Over the next several weeks — before the final draft of the budget is completed and voted on by the commission — Scott said his office will continue to look for reasons to update Greene County’s end-of-year balance, which could be pivotal in providing for unfunded needs in the current recommended budget.

“While this is our best guess, at this point in time, there can easily be and almost always are things that change that can make our position even better or worse,” Scott said.