by Allen Icet, Greene County Collector

As the end of the year approaches, we tend to have lots of enjoyable things on our mind. The festive lighting throughout the city and the thoughts of spending time with family and friends for upcoming holiday celebrations keep us busier than normal.

One item that may slip our mind is the tax deadline that occurs on Sunday, Dec. 31 of this year.

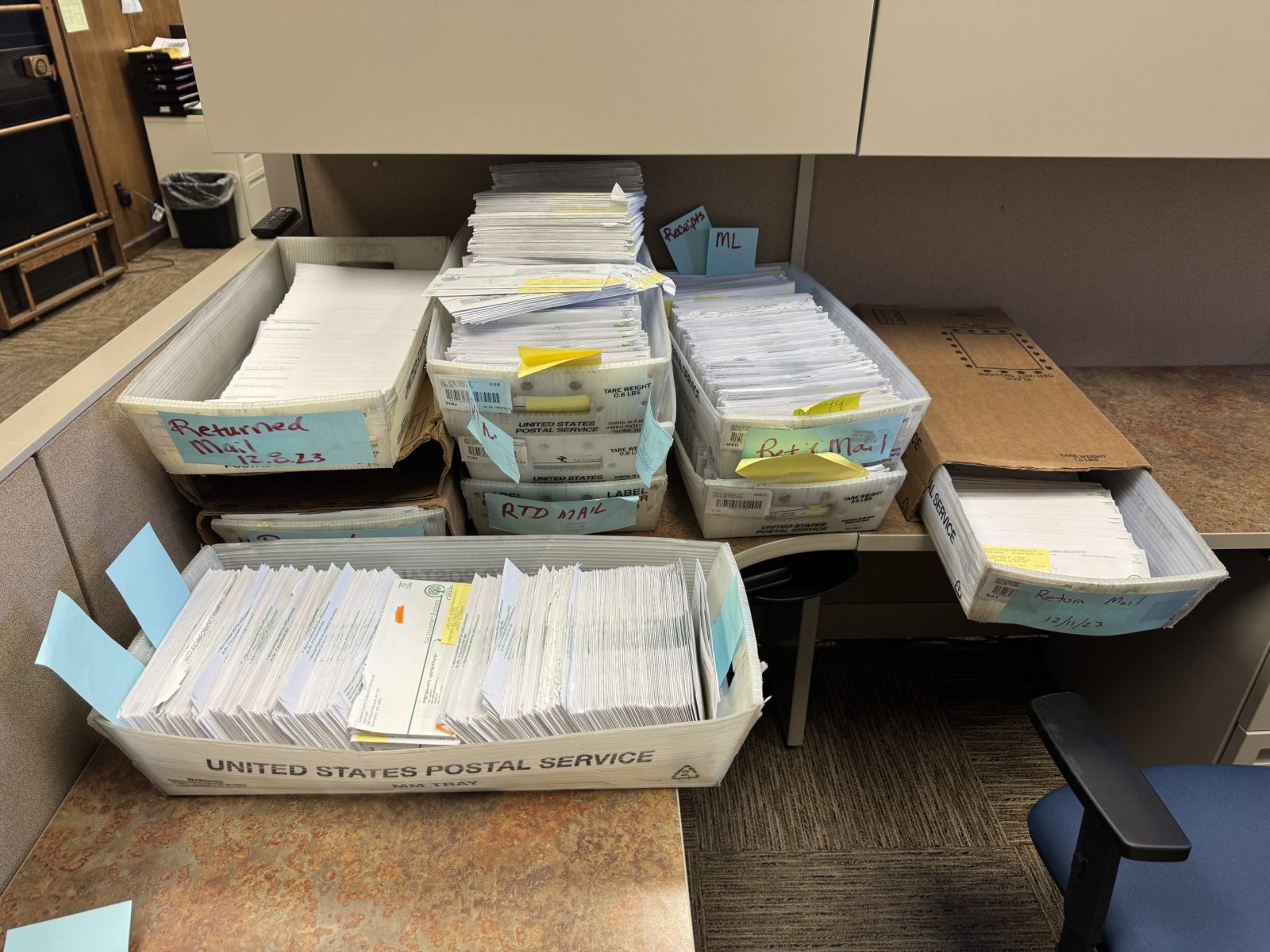

All Greene County taxpayers should have received their statement(s) in the mail by now. If not, there is a good chance it was returned to my office as undeliverable by the U.S. Postal Service. Please be aware that not receiving your statement is not an excuse to avoid payment.

related story

Waiting on property tax statements? You may need to provide an updated address

Greene County Collector of Revenue Allen Icet urges property owners still waiting on tax statements to ensure their address of record is up-to-date.

If you have not received your statement, you can find it and pay it online at www.countycollector.com.

You may also pay via phone by calling (888) 523-0054. Of course, you may pay in person at the Cashier’s Office in Room 109 of the Historic Courthouse through Friday, Dec. 29 at 5:00 p.m.

If you decide to print your statement and mail a check, the envelope must be postmarked by Dec. 31 by the USPS to be considered an on-time payment. Note that the 31st falls on Sunday so the 30th is the last day for this option.

Should your payment be made on Jan. 1 or later you will be subject to a 9% late fee and a 2% interest charge. I encourage you to avoid a last-minute payment which could result in the hefty charges associated with a late payment.

If you have any questions, you may contact my office via email at collectorhelp@greenecountymo.gov or calling (417) 868-4036. Due to high call volume nearing the deadline the quickest way to get a response is by email.

If a taxpayer cannot find an online personal property or real estate tax statement for 2023, has a question about the tax amount, or wants to update their address of record, they will need to contact the Greene County Assessor’s Office, at 417-868-4101 or email assessoronline@greenecountymo.gov.

Download a brochure with details on county personal property and real estate taxes.

Allen Icet is the Greene County Collector.