An independent auditor found the city of Springfield to be in compliance with accounting standards and practices. The unmodified audit, or “clean” opinion, came down from Kansas City-based RSM US Dec. 9.

RSM US Audit Manager Kristen Hughes presented the findings of the audit to the Springfield City Council at a meeting Dec. 13.

“We issued an unmodified opinion,” Hughes said. “That’s certainly one of those requirements to be considered a low-risk auditee for federal grant purposes is that unmodified audit opinion.”

How Springfield spent money it received from the federal government was but one of several key areas the auditors examined. The audit led the City Council to hold a short discussion of the different streams of revenue that fund city government, and a relatively high reliance on sales tax revenue.

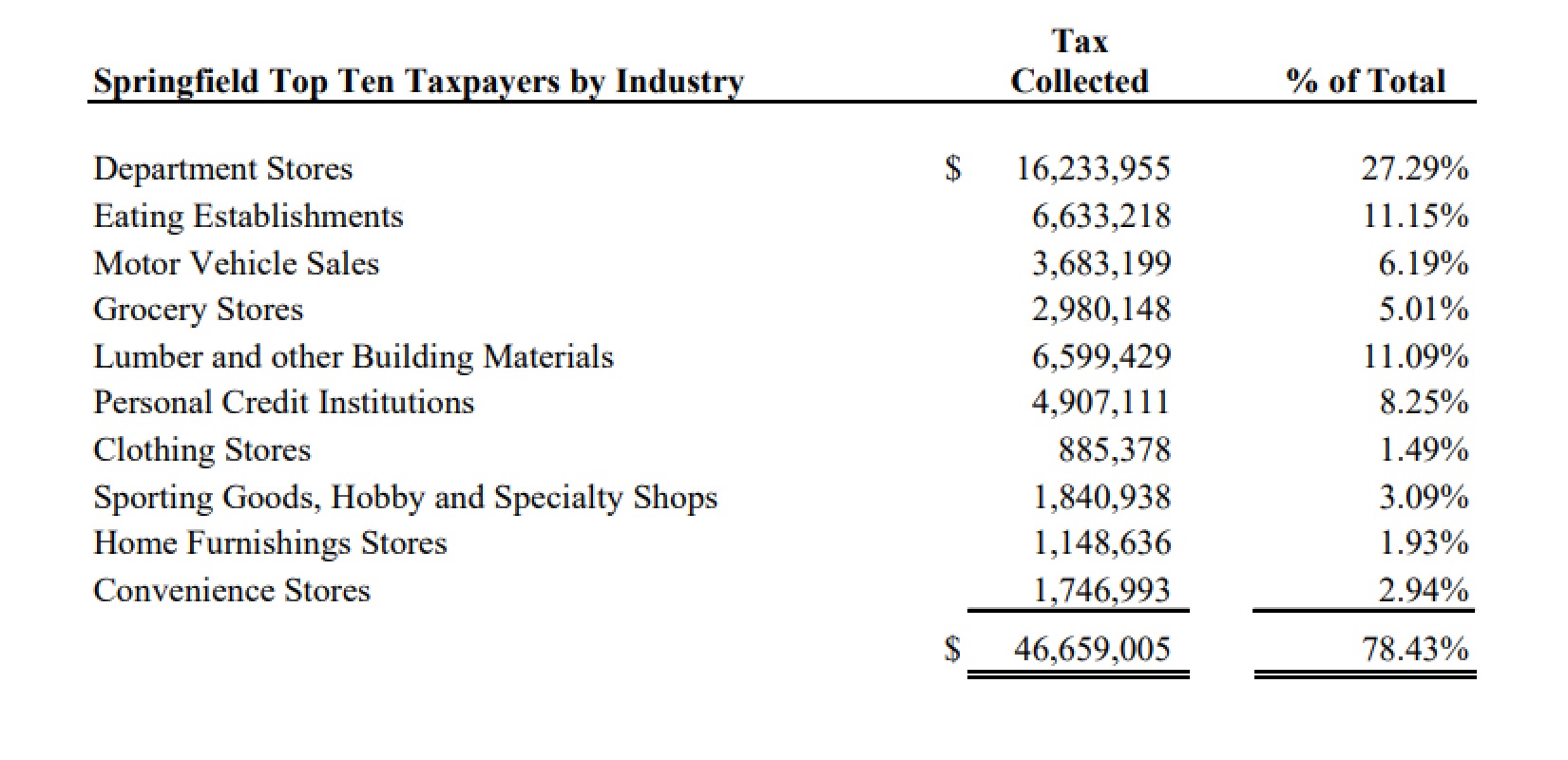

Springfield’s general fund generated almost $100 million in revenue, and $66 million of that comes from sales taxes, including use taxes on online sales. Another $17 million comes from payments in lieu of taxes (what accountants call PILOT revenue), and another $7 million comes from licenses and permit fees.

City’s revenue tied to consumer spending

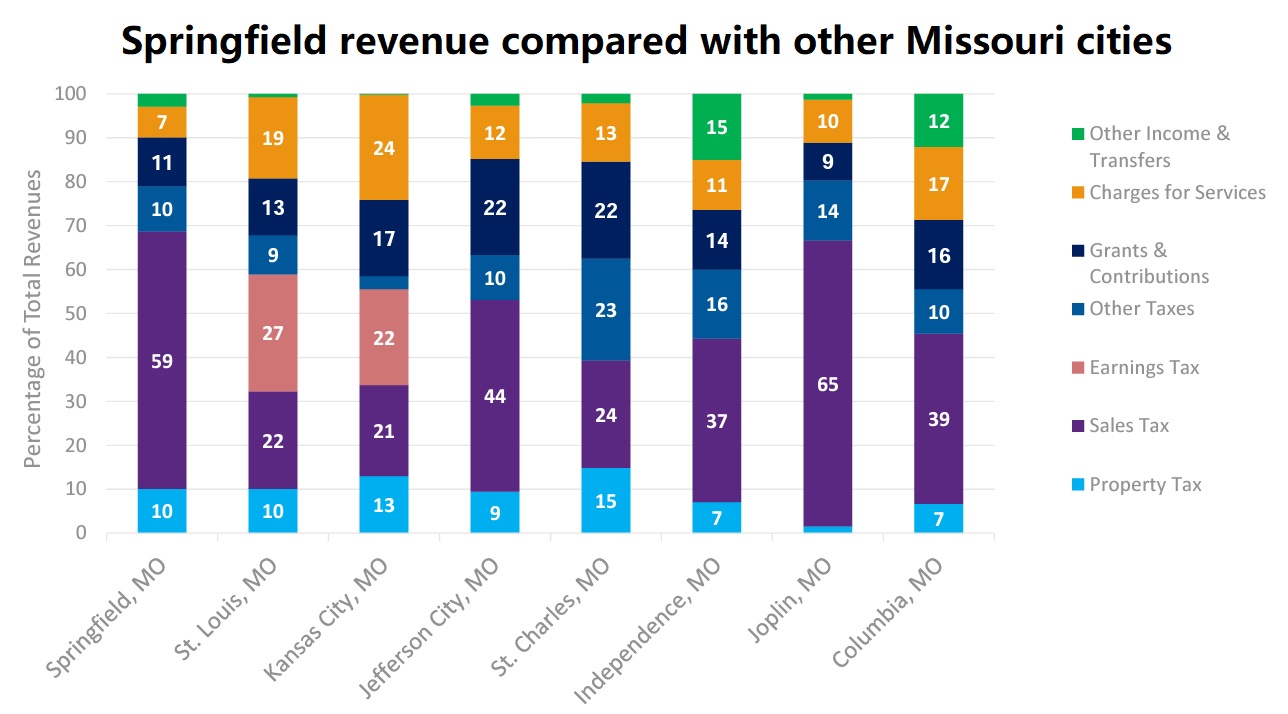

In the 2023 fiscal year, which started July 1, 2022, sales tax revenue is expected to make up about 60 percent of Springfield's overall income. It’s a number that caused City Councilman Richard Ollis to think out loud.

“Sometimes, that can be good, obviously when times are good,” Ollis said. “Does that put us at further financial risk by being not very diversified in our revenue sources?”

From 2020 to 2022, sales tax generation in Springfield climbed from about $47 million per year to $55 million per year, a gain of about 8 percent.

“I do think the reliance on sales tax, like you had mentioned, it’s very positive when the economy is growing full steam and everything is going well,” Springfield Director of Finance David Holtmann said. “We see the downside when we enter a recession or experience an economic downturn, whereas other revenue streams such as property tax — those are much more stable, much more predictable.”

However, Holtmann pointed out property tax revenue is also not usually subject to any dramatic gains.

City Manager Jason Gage brought up the practice of shopping at brick-and-mortar stores giving way to online shopping, but not for the reason you might think. Online shopping can impact sales tax revenue, but Gage said it can also affect property tax values in Springfield.

“Long term, as we think about a shift from purchases in our stores and buildings compared to online purchases and our ability to collect,” Gage said. “If retail and those purchases are not going to occur in buildings to the same degree in the next 5, 10, 20, 30 years, what happens with the buildings? What does it do to the property value of the buildings?”

If a building is vacant, Gage said, it is devalued and does not generate as much property tax revenue for the city and for Greene County as it would if it were occupied. Sales tax revenue can also be negatively affected by online shopping trends, especially if online use taxes are not collected in accordance with local and state laws.

The auditors found Springfield has $19.6 million committed as a rainy day fund. That’s up from $17.4 million in the previous fiscal year.

“We’re fortunate that our economy right now — we know our sales may be tailing off a little bit, but we’ve had a pretty strong economy for a while, pretty strong revenues,” Gage told the City Council. “That’s not the case everywhere, as well, so we’ve had good fortune, we’ve had good policies, good discipline, and you’re in a good, sound financial position.”

The city of Springfield uses Moody’s as its independent investment and financial rating agency. Moody’s assigns ratings to government entities based on their ability to borrow money and repay it, assigning an overall rating for creditworthiness. The city of Springfield has an “Aa1” rating from Moody’s, the second-highest rating on the scale.

Springfield has a 1-percent sales tax for general operations, a ¼-cent sales tax for capital improvements, a ⅛-cent sales tax for transportation, and a ¾-cent sales tax dedicated to the public safety pension plan. Merchants collect sales tax and pay it to the state of Missouri each month, and the state government distributes the money to the city on the 10th day of each month.