Springfield's economic engine is roaring and the needle on the tachometer is moving up. It's time to press the clutch to find a higher gear and more speed.

Members of the Springfield Chamber of Commerce heard presentations from two Federal Reserve Bank economists at a luncheon Aug. 24 at the Ramada Oasis Convention Center in Springfield. The first half of the presentation was full of data for the Springfield metropolitan area, and the second half of the presentation took a broader look at national economic trends and forecasts.

One takeaway? Springfield is growing at a faster rate than Missouri, and faster than the St. Louis metro area.

Economist Nathan Jefferson stressed that his message about the state of Springfield’s economy was positive, but not without some challenges for workers, for employers and for the population as a whole.

The growth could put more pressure on the workforce and housing market, for example, which could be difficult to navigate.

“Especially when you compare Springfield to the rest of Missouri, the metro area here is in a really strong position and has seen some pretty strong growth, and is projected to see some continued strong growth looking at 2023,” said Jefferson, associate regional economist for the Federal Reserve Bank of St. Louis.

Federal Reserve Bank economists say the Springfield metro area will grow quickly over the next year, and then growth is expected to slow for the following four. By the end of 2023, they forecast Springfield will see a 1.7-percent growth rate in gross domestic product (GDP), the measure of the market value of goods and services produced in one place over a certain period of time. Then Springfield's GDP will grow by 1.8 percent from now until the end of 2027, according to their forecasts.

The year-over-year GDP growth for Missouri is forecast at 0.9 percent in 2023 and 1.6 percent from now to the end of 2027.

Springfield’s present economic state

Economic growth in Springfield is moderating as the metro area finishes its rebound from the pandemic. A tight labor market and a tight housing market will continue to create pressure for higher wages, and it will also pressure the prices of goods and services upward. Springfield has seen strong growth in two years since the spring of 2020. While the local, state and national economies have rebounded, Charles Gascon, a regional economist from the Federal Reserve Bank of St. Louis, said the economy is struggling to shift into a higher gear as the engine’s RPMs increase.

The COVID-19-related global recession was one of the deepest on record, Gascon said, but so was the recovery.

“Fiscal support played a key role in it,” Gascon said.

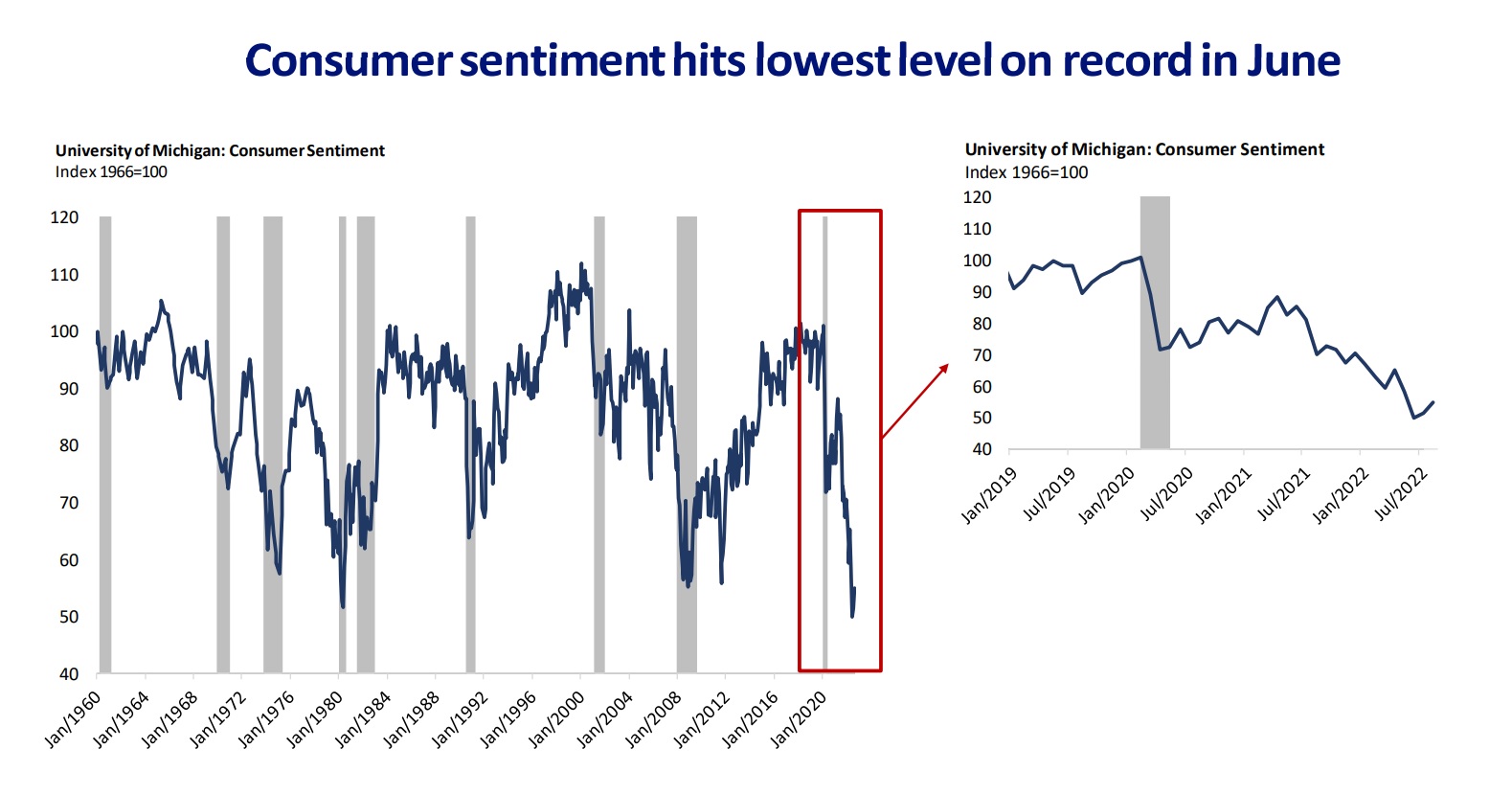

Two major stimulus packages created disposable income for many Americans. In 2022, disposable income levels are falling, and inflation created even less disposable income. The Federal Reserve Bank began measuring a data point called consumer sentiment in 1960. Consumer sentiment in the United States hit a record low in summer of 2022.

“This is what has prompted a lot of concerns of us slowing economic demand, because people’s real incomes are falling. It means they have less money to spend on goods and services, and the first place that this has really kind of brought on a red flag is when we look at consumer sentiment,” Gascon said.

How COVID-19 affected the world’s economy

The Springfield employment decline of the COVID-19 pandemic was worse than the dot-com crash of the early 2000s and the Great Recession of 2007 combined and doubled. However, the COVID-related economic decline in Springfield was not as pronounced as the decline across the nation as a whole.

“One thing that is a particular strength of the Springfield area economy is that some of its core sectors — education, health care, professional services — these sectors are a lot more resilient, a lot less cyclical than other sectors, so we’re not seeing the same kind of cycle of boom and bust as maybe economies that are primarily built around tourism, for example,” Jefferson said.

The difficulty employers have in hiring new workers is more prominent in certain job sectors, such as the leisure and hospitality industries.

“What we have now is a historically low unemployment rate of 2.3 percent,” Jefferson said. “A very tight labor market, as many of you have no doubt experienced.”

Springfield housing market inventory below national average

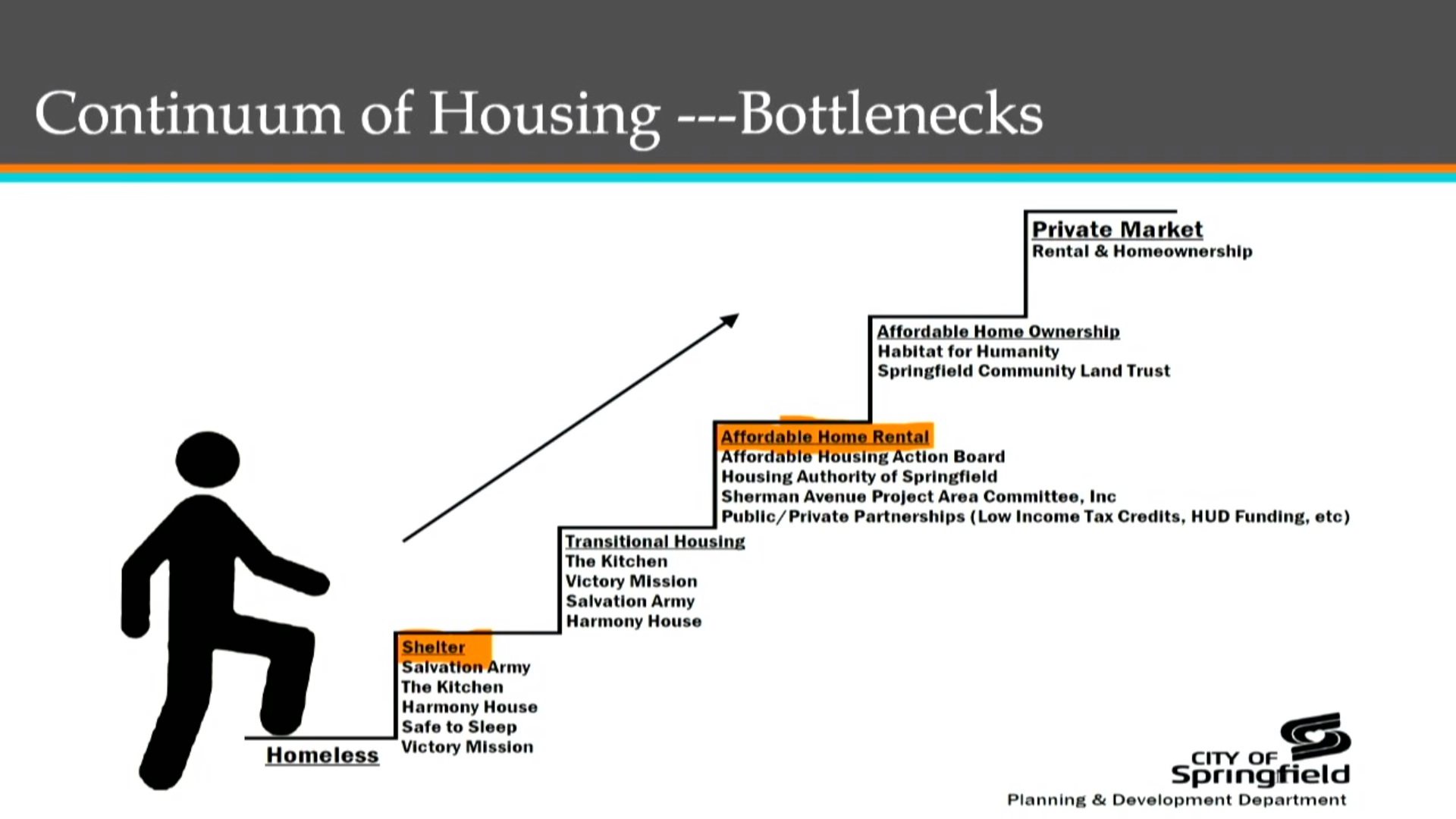

Jefferson showed data on new housing activity that showed the housing market in Springfield rebounded about half as strong as the national market.

“If you’ve heard about supply chain issues, if you’ve heard about labor shortages, this is where you see the impact of this,” Jefferson said. “Construction activity hasn’t been quite as strong in the last year or so as it’s been immediately after the early 2000s or in the Great Recession. Now, as a result of that, housing inventories in Springfield are below the national average.”

“If you’ve tried to buy a house, if you are a realtor, if you’re a mortgage banker, if you’re at all involved in the housing market, you know that’s been historically a hot market in the last year, year and a half, at least until interest rates started increasing,” Jefferson said.

“You have a lot of demand, and across the broad swatch of the economy, industries are really struggling to keep up with the supply to meet that demand.”

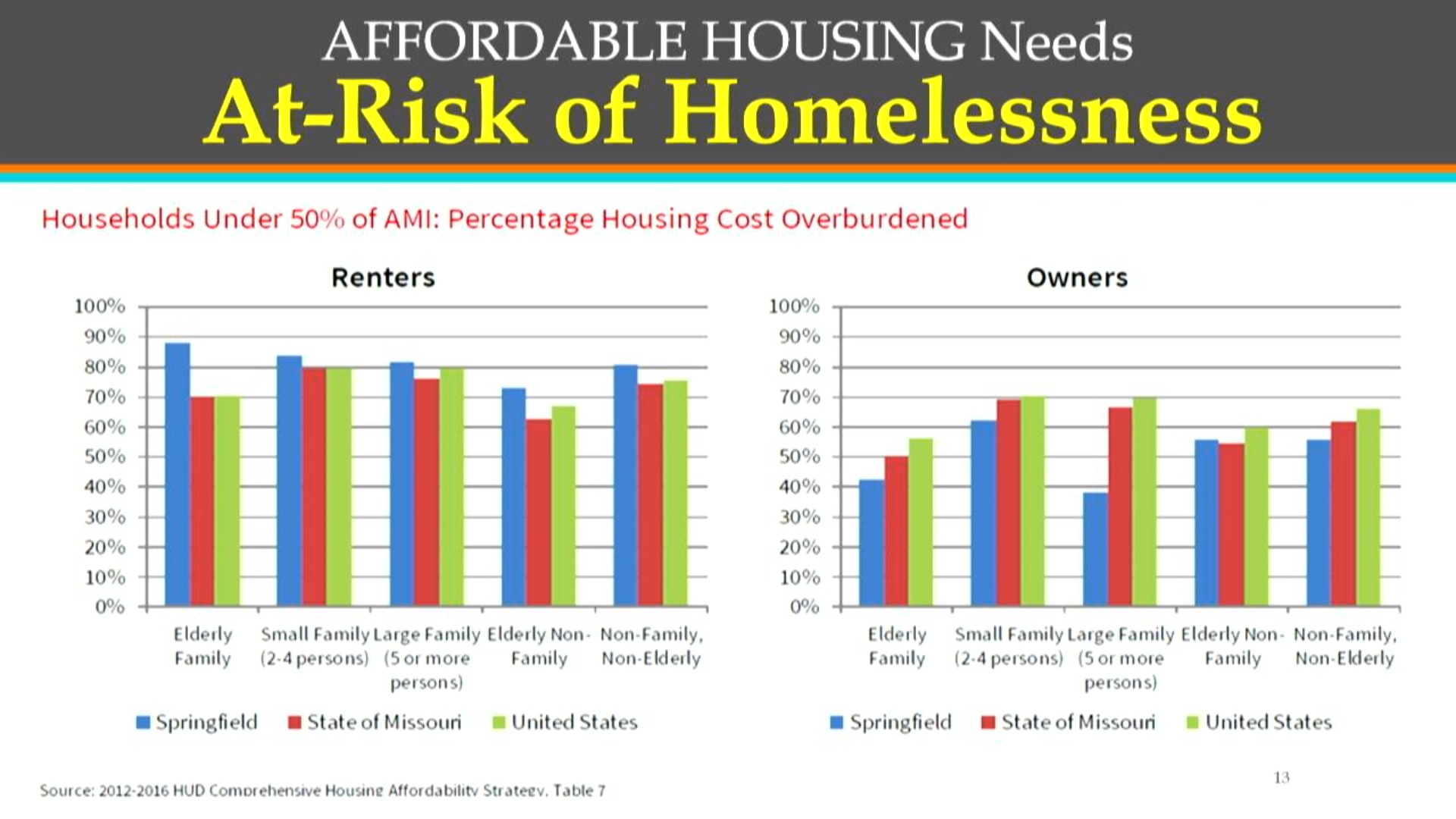

The housing market is one of the strongest indicators of a local economy. It is also an area of the economy with some of the highest associated risks.

“We want to add more people to the region; that’s a good thing,” Gascon said. He then constructed an analogy with the 400-some people in the room at the Oasis Convention Center. “We can add more people to this room right now, and that’s a good thing, but only if we have more food for them to eat. That’s where these resources come into play.”

Credit conditions are tough for many borrowers at present. Great Southern Bank, for example, lists the interest rate on a conventional 30-year fixed-rate mortgage loan at 5.25 percent. The rate for a construction-only loan is at 5.5 percent.

“We need more housing, we need to find ways to train more people, younger workers to get into the workforce so that we can have the resources that are available so that the standards of living — household incomes for example — go up,” Gascon said. “Otherwise, you can find yourselves in situations where populations are increasing, and our standards of living are actually declining because housing is no longer affordable, and it presents a whole other list of challenges.”

Springfield’s population, workforce expected to grow

Springfield is outpacing many of its counterparts in the Midwest, and is going to grow at a faster rate than many other cities in Missouri.

“In the long run, Springfield is projected to have stronger population growth than Missouri is; it’s going to be stronger than Missouri and stronger than the U.S. population as a whole,” Jefferson said.

This is good news, Jefferson said, for Springfield’s metropolitan area. Springfield’s workforce population is expected to grow by about 0.8 percent from now until 2027, and unemployment may also creep up to 2.9 percent as a result of the workforce population growth. For the moment, there are an average of two job openings advertised for every unemployed person.

“Now, this may bring challenges as well,” Jefferson said. “This is a better problem for a metro area to have than a drain of workers.”

Springfield’s prime age population, persons ages 25-54 who are statistically most likely to take part in the workforce, is projected to grow by 2.9 percent over the next five years. Across Missouri, the same age group’s population is expected to shrink by 0.1 percent.

“Those demographics are the primary determinant of long-term growth,” Jefferson said. “Looking at five years, looking a decade out — so when you think about what policies are going to have a direct impact 10 years down the road, this is the kind of growth that our economic-based forecasts see as the foundation for economic growth forward.”

In total, the Fed forecasts Springfield’s metro area population of about 359,000 people to grow by 4 percent over the next five years, reaching 373,360 by the end of 2027 — a gain of 14,360 people, or almost the entire population of the suburb of Republic.

“Now, this may bring a challenge as well, obviously, keeping an eye on what this means for demand and inflation,” Jefferson said. “This means new supply challenges, this means an influx of workers will have to deal or try to find a way to deal with this increased demand.”

Outlook murky and unclear

Recession fears, global instability — like the Russian invasion of Ukraine and its trade disruptions on the Black Sea — and the uncertainty of how the Federal Reserve Bank is supposed to operate are all factors that muddle the growth outlook for Missouri and for the United States.

“There’s long ways to go to move those inflation expectations back down to where they need to be,” Gascon said.

Gascon said there has been a decline in consumption, but consumption across the economy is still strong. Many people who received stimulus payments saved some of the money, and so they are using it now to soften the impact of inflation. Gascon said inflation is forecast to continue to exceed a 2-percent rate for some time.

“There has been a slowdown in goods consumption, but overall total consumption still remains pretty strong and is relatively stable,” Gascon said. “Our goal is to try to point policy in the right place so we don’t have a recession.”

Curbing inflation is a key priority for the Fed, functioning as a central bank, to attempt to hold its credibility with Americans.

“We think there is a path to a soft landing,” Gascon said.

According to the Federal Reserve Bank, economic growth in Springfield and the rest of Missouri may slow for the remainder of 2022 and into 2023.