Robust demand has lowered the risk of 2023 recession, aided by stronger-than-expected population growth. These were two of many key takeaways from a presentation by two Federal Reserve Economists in Springfield.

Members of the Springfield Chamber of Commerce heard presentations from two Federal Reserve Bank economists at a luncheon Aug. 16 at the Ramada Oasis Convention Center in Springfield. Strong demand helped hush cries of a looming recession risk, spurred by a population boom that is above the regional average, Nathan Jefferson, associate regional economist, Federal Reserve Bank of St. Louis, said Wednesday.

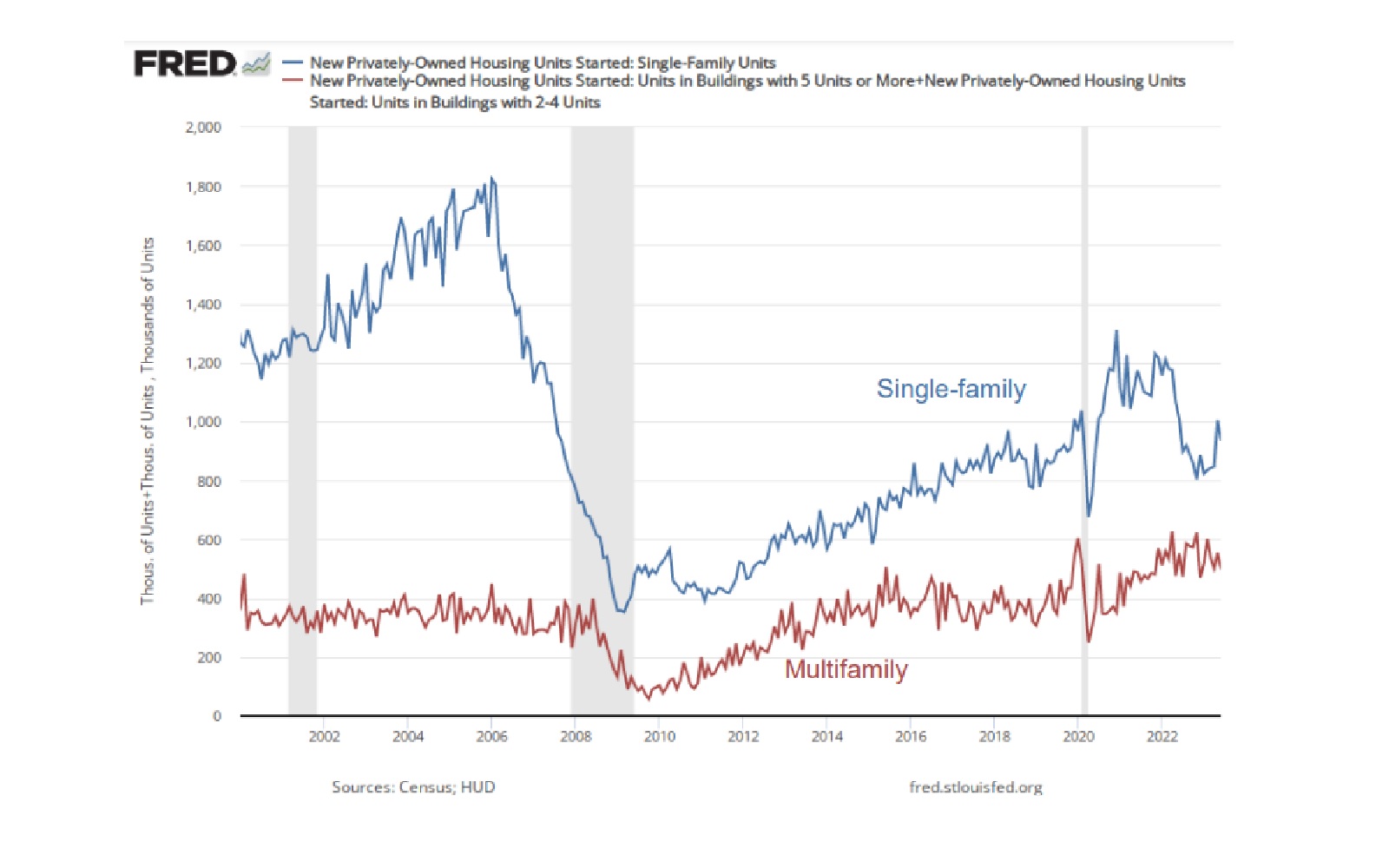

Springfield saw its economic output grow more than expected in the first half of the year, and housing affordability remains a challenge for buyers even as new-home construction for single families continues to rise, Kathleen Navin, CBE Federal Reserve Bank of St. Louis, said. While the labor market remains tight, there are signs that it is softening. Employers' labor demand continues to exceed potential employees' labor supply, Navin said.

After bank deposits began to unwind in the first half of the year, lending slowed. That's a factor that's caused forecasting to subdue growth in the next two years, Navin said, which will likely cause the unemployment rate to drift higher. Despite the slowdown in lending, inflation looks to moderate toward the 2% objective through 2025.

Given the robust economy, Navin expects the Fed to raise interest rates one more time this year. While she expects the housing market to cool, the U.S. economic growth surprised to the upside in the first half of 2023, easing concerns of a recession late this year, Navin said. As the labor markets come back in better balance, the economy will support a return to 2% inflation, she said.

A takeaway that has left some economists scratching their heads: the surprisingly resilient consumer sector, supported by excess savings accumulated during the COVID-19 pandemic and a tight labor market, has limited the slowing in overall growth, Navin said. But this trend is likely to decline into next year, she said.