If the City Council acts before Jan. 24, Springfield voters will have a decision to make about lodging tax, sometimes called hotel occupancy tax, when they go to the polling places on April 4.

Springfield City Administrator Jason Gage made an analogy that Springfield has three small lodging taxes that stack up to make a three-layered cake of tax collection. The potential April ballot measure would keep revenue streams going to the same places, but would consolidate the three taxes into a single hotel tax.

“We’ve had three separate layers of a cake, in essence, with three different actions that built to the 5 percent,” Gage said. “The collection approach would be the same.”

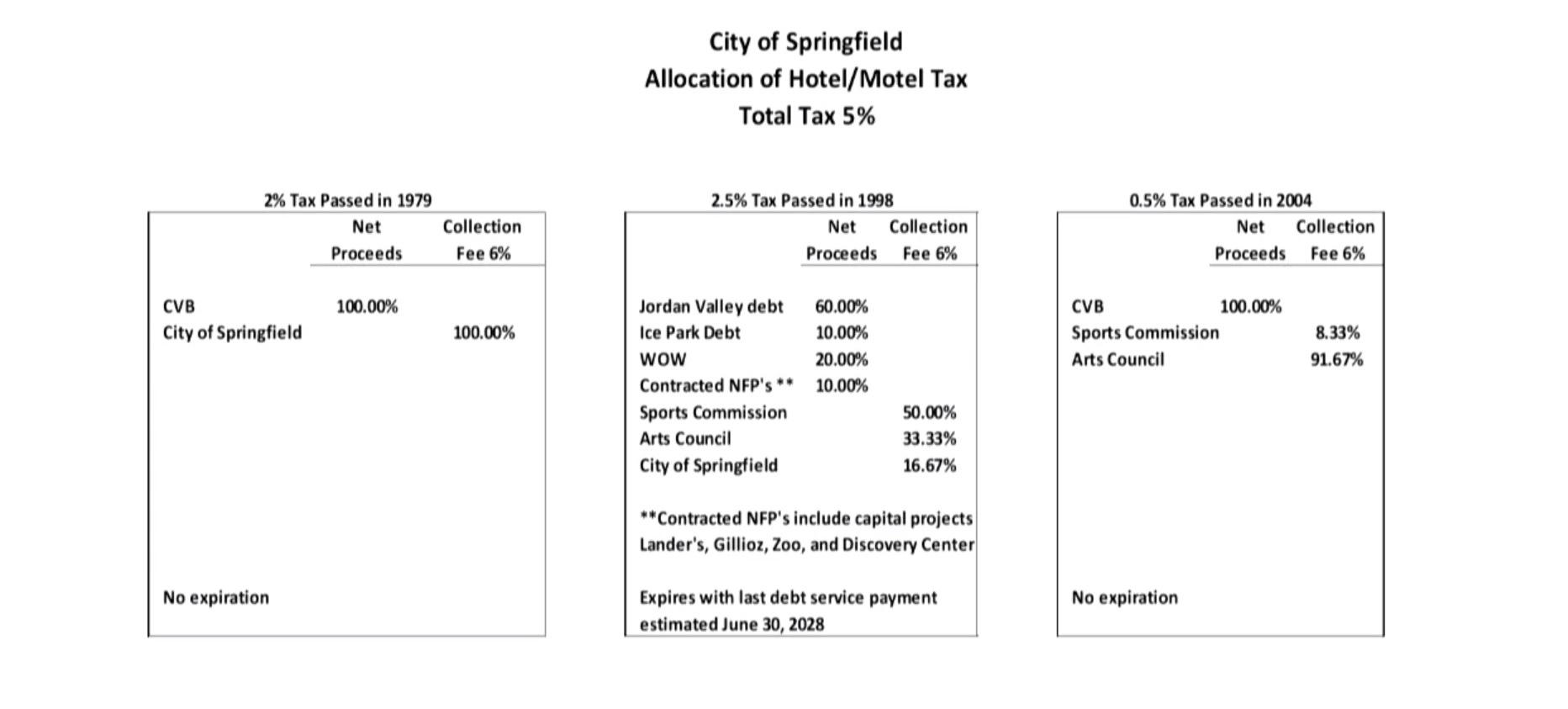

Springfield voters enacted a 2-percent lodging tax in 1979, a 2 and ½-percent lodging tax addition approved in 1998, and a ½-percent lodging tax enacted in 2004. The 2004 tax is earmarked to attract sporting events and conventions.

Gage said some action and buy-in from voters could simplify the structure of the hotel and motel rental tax. If the Springfield City Council puts the measure on ballots, and if voters enact it, Springfield would move ahead with a consolidated 5-percent hotel/motel tax. The City Council will hold the first reading on a bill containing the ballot measure Jan. 9, and has a legal deadline of Jan. 24 for the question to make ballots.

“We would like to make it a one-layered cake right now,” Gage said.

The city’s tourism and convention fund accounts for half of the total lodging tax, and is given to the Springfield Convention and Visitors Bureau to promote Springfield to potential visitors.

Tracy Kimberlin just wrapped up a 35-year career with the Springfield Convention and Visitors Bureau, retiring as its president at the end of 2022. Before his final day, Kimberlin provided some analysis of the ballot proposal.

“The proposal that was presented to City Council would redistribute half of a cent of the 5-percent hotel tax that used to go to Wonders of Wildlife, and right now it's just getting banked, but it would redistribute that,” Kimberlin said.

Kimberlin said the consolidation would make Springfield better able to direct revenue toward agencies and tourist attractions that drive business back into the hotel and lodging industry. Kimberlin believes members of Springfield’s business community understand the lodging tax and what it does. He points out the number of Greene County residents employed in the travel industry.

“There's roughly 20,000 people that work in the industry,” Kimberlin said. “And I think that a lot of people understand that the travel industry generates a lot of revenue for the community.”

Keeping up with other Missourians

Zone 4 Councilman Matthew Simpson spoke in favor of the consolidation plan when it surfaced at a City Council meeting in November 2022.

“It makes a lot of sense to make this permanent, clean up the language, reallocate now, it makes sense to do that together as a package,” Simpson said.

Simpson said he supports the idea of raising the lodging tax to something around 7 or 7.5 percent. Kansas City, Missouri has a 7.5-percent hotel occupancy tax. St. Louis has two taxes that combine to make a 7.25-percent occupancy tax. Jefferson City has a 7-percent lodging tax.

“We also know that these investments pay strong dividends,” Simpson said. “In addition to the economic development aspect of it, these provide community amenities that residents can enjoy that are paid for by people from out of town.”

However, Gage said the hotel association members communicated they were comfortable with a 5-percent lodging tax, but “not at an enhanced level,” meaning they don’t want the rate to go above 5 percent.

Cost breakdown

The three hotel taxes are budgeted to bring in about $3.25 million per year in revenue for the Springfield Convention and Visitors Bureau.

The breakdown, according to documentation supplied to the Springfield City Council, includes a $97,708 payment to the Springfield Sports Commission for operations, a $65,073 payment to Springfield Arts Council for operations, $367,380 previously paid to Wonders of Wildlife to be determined by the Springfield Hotel/Motel Tax Reallocation Committee and $2,387,970 for Jordan Valley Park debt service.

Kimberlin said the Springfield Arts Council reallocates much of the funding it receives.

“They would grant most of that to other arts organizations, and applications that generate overnight travel from those organizations would be given priority,” Kimberlin said. “They would also use $30,000 for regional collaborative marketing, and then about $16,000 for administrative expenses.”

The net budget for the sports commission — all money from the city of Springfield — is $200,000. According to Kimberlin, the Springfield Arts Council and the Springfield Sports Commission take in $108,000 each from the current hotel taxes per year.

Beyond the specific dollar amounts, Councilman Craig Hosmer sees the hotel tax as a way to fund promotion and economic fuel for Springfield.

“It’s broad-based economic development,” Hosmer said. “You bring people to Springfield because of sports tourism, theater, arts, whatever, everybody gets help — restaurants, retail and the city.”

Once debt is retired at Jordan Valley, Hosmer believes the lodging tax revenue can be applied to other projects that would drive tourism.

“The big project, I think, would be a convention center eventually, but there are projects now,” Hosmer said. “Whether it’s the Fieldhouse, whether it’s other parks projects, whether it’s some of the theaters needing repairs that need funded — we also know that the sports commission and the arts council should be funded at a much higher level than they are.”

The ‘dead animal museum’ guffaw

June 27, 2022, the Springfield City Council voted to spend about $4.2 million with the Springfield Convention Visitors Bureau over the current fiscal year, from July 1, 2022-June 30, 2023. The Springfield CVB is a 501(c)6 nonprofit with a staff of about 20 employees. A volunteer board of 15 business leaders is responsible for its oversight.

Revenue from the 1998 tax was marked to go to Jordan Valley Ice Park, Wonders of Wildlife museum, and nonprofit groups that include Springfield Little Theatre, Springfield Landmark Preservation Trust and Friends of the Zoo. Sixty percent of the revenue goes to retire the debt for construction of Jordan Valley Park, 10 percent goes to Jordan Valley Ice Park, 20 percent goes to Wonders of Wildlife, and 10 percent is split among three contracted not-for-profit groups.

“There was a lot of controversy, some of you may remember, on the ‘98 tax; they thought it was Johnny Morris’ dead animal museum tax,” Kimberlin said. “And so that went on for months on radio talk shows and whatnot, but it passed three-to-one.”

In 2011, Wonders of Wildlife stopped taking tax revenue because the museum was closed. According to past reporting by the Springfield News-Leader, an internal audit in 2011 showed “the funds generated from this tax measure were not being used in accordance with the stated ballot language.”

Of the not-for-profit groups, the Springfield Sports Commission takes about 5 percent of the overall revenue from the 1998 tax, and the Springfield Arts Council gets about 3.3 percent.

“When the 1998 tax expires, so does a large portion of the sports commission and arts council funding, so if that were to fall off the books in 2028, the majority of their current funding would also go away,” said David Holtmann, Springfield's director of finance.

Short-term rentals skirt the tax

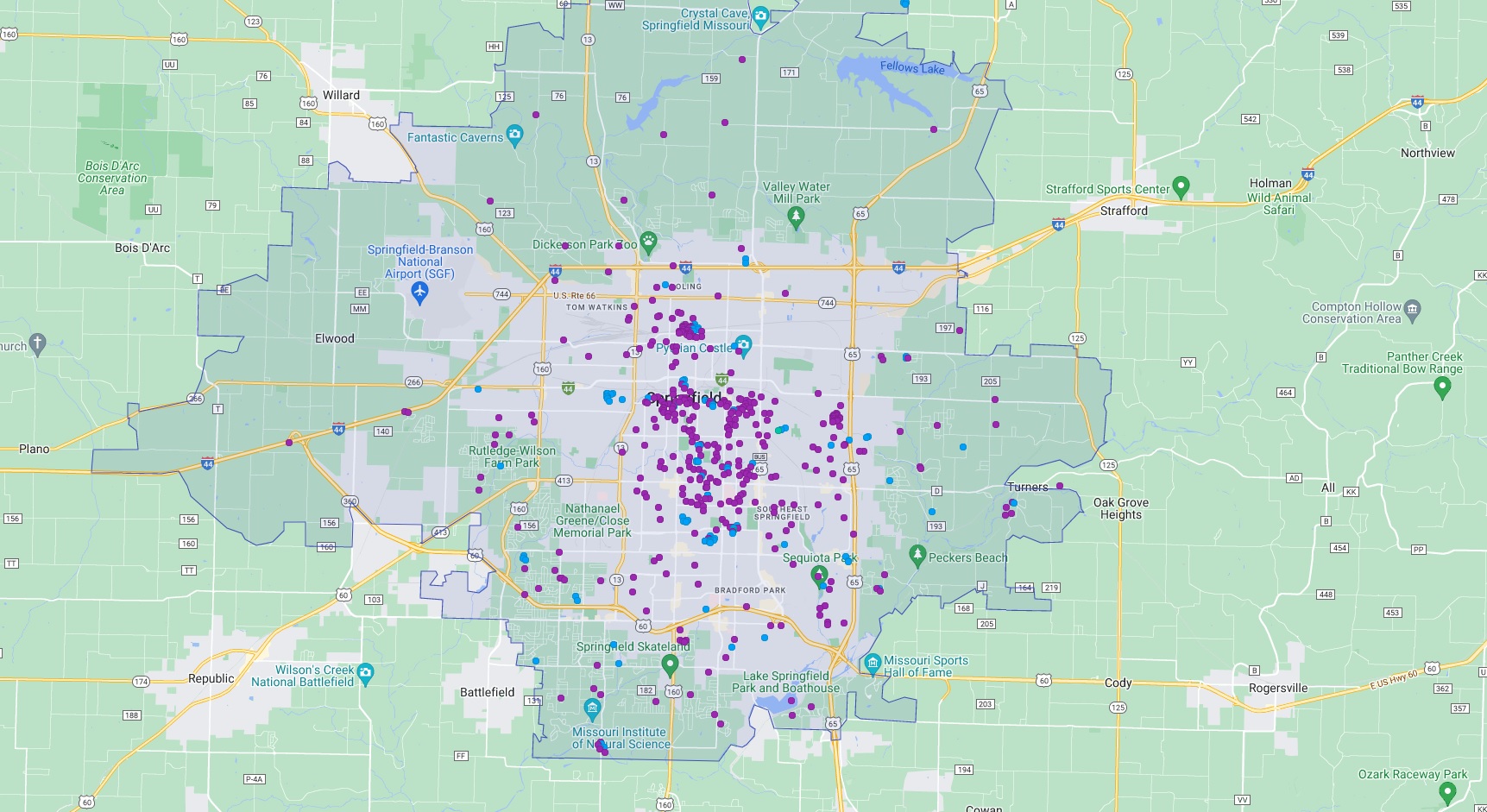

Springfield’s lodging tax is not imposed on short-term rentals, defined as buildings with eight or fewer bedrooms.

“We have proposed that the city put on the ballot a measure to cause short-term rentals in Springfield to pay the hotel tax, which they currently do not,” Kimberlin said.

Holtmann explained these include rentals available on online hosting platforms like VRBO and Airbnb.

“As we know, short-term rentals have — the popularity has increased significantly over the years, and they’re directly competing with our hotels and motels that are collecting a lodging tax,” Holtmann said. “Expanding the hotel/motel tax for our short-term rentals would allow a more level playing field for the short-term rentals and the hotel and motel associations.”

The Springfield Convention and Visitors Bureau found that more than 350 Springfield homes were being used as short-term rentals in 2022, and the daily average rate to rent a unit is $155. Holtmann said only 200 of those units are licensed. Identifying and tracking the unlicensed rentals, Holtmann said, has proven difficult.

Springfield’s sports tourism investment

Three multimillion Springfield projects built around sports are economic keys in the public and private sector. The CVB hopes the public revamping of Cooper Park, the retooling of the Ozark Empire Fairgrounds, and the private development at Betty and Bobby Allison Sports Town in west Springfield will all lead athletes and their families to the Ozarks for years to come.

Sports tourism is a key point of emphasis for the Springfield Convention and Visitors Bureau, the Springfield city government, and for the Springfield-Greene County Park Board. The Park Board will receive more than $22 million in American Rescue Plan Act (ARPA) funding for renovations at Cooper Park and Sports Complex in an effort to attract more games and larger events.

Cooper Park is home to Lake Country Soccer’s fields, the Killian Sports Complex and softball stadium and the Cooper Tennis Complex.

According to the Forward SGF master planning documents, Springfield parks generate $13 million to $15 million annually for the local economy. Facilities host more than 50 national, regional, state and local sports tournaments.

Parks and recreational opportunities were ranked highly by Springfield residents who participated in community outreach efforts to gather input, during which 45.2 percent of resident questionnaire respondents voted park and outdoor assets as Springfield’s greatest strength.

“We are getting ready to open a whole lot of sports facilities,” Kimberlin said.

The marketing investment, however, doesn’t match the investment in fields and facilities.

“Three projects there totaling about $75 million and we have a $200,000 marketing budget,” Kimberlin said. “That doesn’t fly.”

Pay to play in the tourism game

Kimberlin made comparisons with other sports events and tourism associations in neighboring cities and in other places of comparable size to Springfield. When it comes to marketing, Springfield does not spend as much money trying to attract events as the rest of the competition, he said.

“We are certainly at the bottom of that list,” Kimberlin said. “If we get the additional funding, we’ll be about in the mid-range, about the 50th percentile, maybe a little bit less, but certainly in a lot better position than where we are currently.”

The Springfield Sports Commission has a staff of two persons, a director and an assistant director. Kimberlin said additional revenue would allow it to hire another person whose role would be sales-based, creating the opportunity to generate more money.

Kimberlin would like for the sports commission to be able to spend about $100,000 per year on bid fees, money fronted in an effort to attract events to Springfield. It’s a pay-to-play environment, but Kimberlin said Springfield can’t win if it isn’t willing to pay the bid fees.

“One of the things about sporting groups is they do require a lot of bid fees, sponsorships and things of that nature,” Kimberlin said.

The USA Pickleball Middle States Regional is booked for June 1-4, 2023, and May 30-June 2, 2024, at Cooper Tennis Complex. Springfield edged Chicago and Milwaukee for the right to host the pickleball tournament, which is expected to draw between 800 and 1,000 players, plus their loved ones and other spectators.

Sports tourism is “blue ribbon” rated in the Springfield Community Focus Report, which examines issues and structures in Springfield and Greene County. The authors assign “blue ribbons,” or areas and events that are favorable, and “red flags,” potential roadblocks or areas of concern that could lead to adversity. The blue ribbons and red flags are used to plan what can be done over a two-year period to make Springfield a better place.

“Despite economic downturns from recessions and the pandemic, athletes, coaches and extended families have continued to travel to Springfield for tournaments and championships, bringing revenue to the city’s hotels, restaurants, retail outlets and tourist attractions,” the report reads.