Inflation is putting pressure on just about everyone's wallets here in Springfield, but are wages keeping up with the dollar's value?

The nation watched inflation soar in 2022, with consumer prices now 8.6 percent higher than they were a year ago, according to May’s inflation data from the U.S. Bureau of Labor Statistics. That's the highest climb in prices since 1981, and far above the Fed's 2 percent target.

Here in Springfield, consumer price inflation sits even higher at 8.8 percent, according to regional inflation data.

Meanwhile, the most recent data for wages in Springfield show paychecks have increased, but only at a creep. The average annual salary for all occupations in the Springfield metro area inched up 2 percent from May 2020 to May 2021 (the most recent data), according to the Bureau of Labor Statistics. The average yearly salary is now $45,550, and the average hourly wage is $21.90.

Story continues below:

It’s unclear if there's been more aggressive wage growth in the metro area in the year since, as the BLS won’t report those figures until 2023.

However, some of the latest figures on weekly wages in Greene County — collected through a different BLS report —showed an 8.6 percent increase from December 2020 to December 2021. That exceeds the national gain of 5.9 percent. But the average weekly wage in Greene County ($1,085) still fell below the national average of $1,418 at that time.

Inflation pressures wages, which pressures employers

While some Springfield wage earners try to make their money add up, the prices they pay for their everyday needs are rising at rates faster than the money can stack.

Ted Abernathy is the managing partner of Economic Leadership, LLC, a consulting firm contracted with the Missouri Chamber of Commerce and Industry. Each quarter, Abernathy provides a video update analyzing the latest trends and happenings in the Missouri economy.

“It's not a surprise that too many dollars chasing too few goods caused us to have inflation. It's record-setting for the last 40 years,” Abernathy said. “Right now, (inflation is) the hottest topic in the economy. It's driving up employment costs. The amount of wages has jumped pretty dramatically in the last year, and there’s no end in sight for that as we all compete for labor.”

Abernathy said that across Missouri, employers have a smaller pool of applicants to choose from.

“We're having not nearly as many people applying for jobs that are vacant. The other part of the story is the quit rate. A lot of people have different choices, so they’re quitting their current jobs, in many cases, changing industries altogether,” Abernathy said.

With a bounty of job listings, postings and opportunities to move or advance, workers of all skill and experience levels are trying to take advantage. Even firmly entrenched workers may be tempted to look around to see what else is available.

“We're going to be facing this problem with the lack of workforce for a long time to come,” Abernathy said. “Overall, the economy is in a state of flux right now.”

MORE ON INFLATION

Eggs, avocados and staff pay: Inflation weighs on restaurants

“Inflation” and “wage demand” are two buzzwords circling downtown Springfield, but if you want to learn more about what they mean in a real sense, ask a restaurateur about eggs and avocados.

CPR for the CPI

The Consumer Price Index (CPI) — what many simply refer to as an “inflation measure” — is the average change in prices over time. The BLS calculates the CPI as a weighted average of prices for a “basket of goods and services” representative of aggregate consumer spending.

As mentioned earlier, the national CPI rose 8.6 percent from May 2020 to May 2021, and here in Springfield, it reached 8.8 percent.

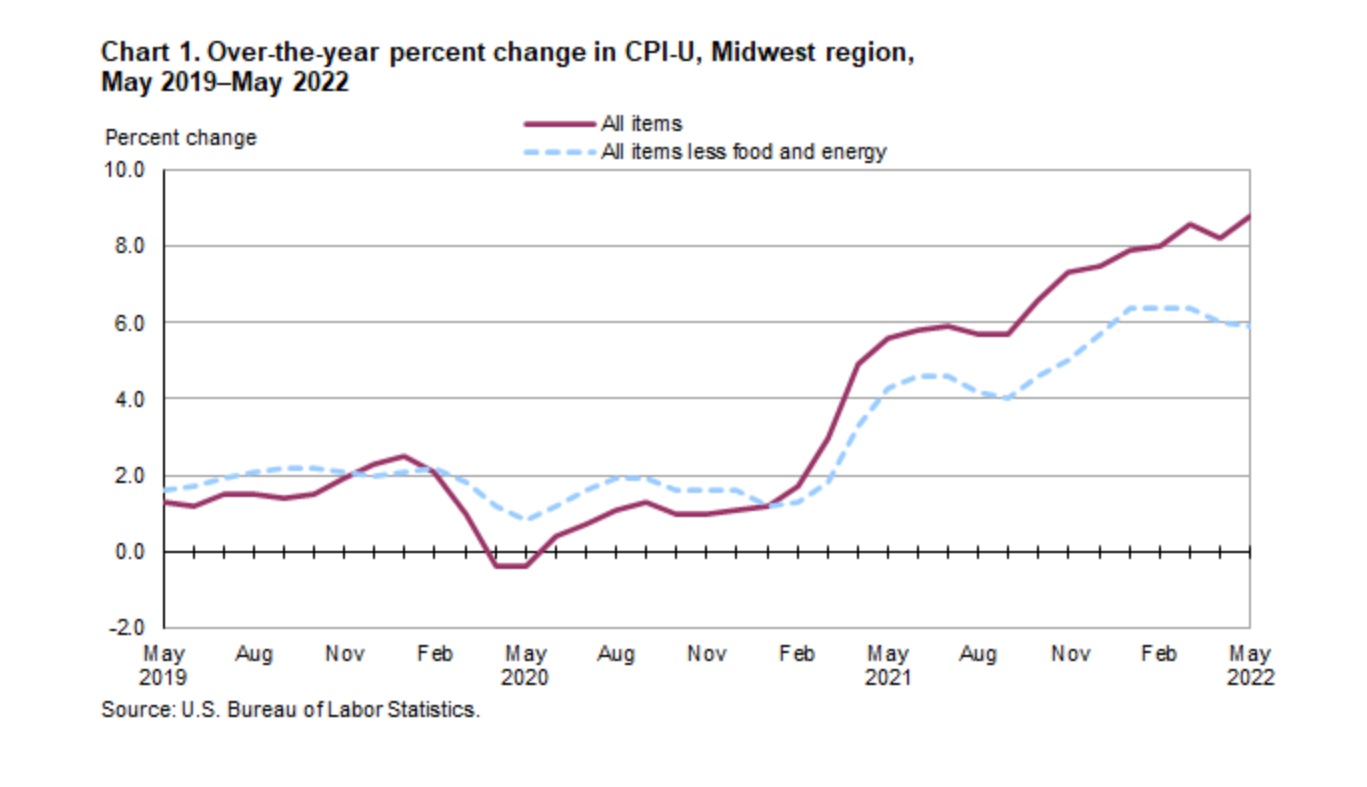

The hockey-stick climb began two years ago in the Midwest. The CPI for the region has not gone negative since May 2020.

From May 2020 to May 2022, the CPI has cumulatively risen 14.9 percent in the Midwest region, according to BLS figures.

Put another way, the median household income in Springfield in 2020 was $37,491 per year. To equal that income level in May 2022, you’d need to make $43,077.

Cutbacks happening across different classes

Workers in some job sectors experienced better wage growth than others in the past two years. People in the legal field saw their average annual salaries jump from $74,870 in 2020 to $86,460 in 2021, an average raise of 15.4 percent.

Worker groups who saw the worst wage movement included educators and librarians, who saw a 0.4-percent decrease from an average yearly wage of $48,490 in 2020 to $48,290 in 2021. There were an estimated 11,480 people employed in schools and libraries in Springfield in 2021.

While low-income earners will be the first to feel higher prices in stores, at gas pumps and on their monthly billing statements, anyone who spends money in Springfield has to spend more in 2022 to get similar products and services to what they bought in 2020.

Even upper and middle-class earners are cutting back and tightening their belts on some purchases.

Justin Skinner is a self-employed commercial real estate agent, who has noticed his gas station trips, grocery bills, business software subscriptions and rents going up. At home, he’s trying to cook more often and eat less restaurant food. At work and in the investment world, he said he’s trying to avoid paying higher interest rates and giving the same advice to his clients.

“We are focused on taking on fixed debt for real estate instead of variable rate debt because of the unknown in interest rates,” Skinner said. “I know there are several investors spooked right now because of rising interest rates, and home buyers are losing buying power, as well.”

Downtown Springfield restaurant Druff’s owner Vance Hall said he tried to reduce turnover at his business by offering raises to his employees, and paying new employees at higher rates.

“The shortest answer is that we have to pay people more, which is fine; we probably should have been doing that before,” Hall said. “There are some realities where I literally can’t, and there are some realities about what perceptions and expectations are that I can’t get to today, but that’s the easiest way to keep decent people.”

Credit card debt signals

While money is losing its buying power, credit card use is also on the rise.

On March 8, 2022, WalletHub published a study on credit card debt. Among other examinations, the researchers broke down credit card debt by 182 of the largest cities in the United States.

“Consumers added a total of $87.3 billion in new credit card debt to their tab during 2021, capped off by a $74.1 billion increase during the fourth quarter alone,” the main findings from WalletHub read. “For context, the average annual increase in credit card debt over the past 10 years is just $48.5 billion.”

WalletHub senior researcher Alina Comoreanu ranked Springfield 168th of 182 cities when it came to paying down credit card debt in 2021 — which means Springfieldians, perhaps more strapped for cash, aren’t paying down their debts at anywhere near the speeds as residents of other major cities.

Springfield's credit card debt

The data collected from the U.S. Census Bureau, the Federal Reserve and TransUnion shows that the average Springfield household had $8,470 in credit card debt, and decreased its debt by $1,201.

The estimates are that Springfield's population combined holds about $643 million in credit card debt.

Paying off credit card debt is about to get even more difficult for those who don't make the minimum monthly payment. As the Federal Reserve announces interest rate hikes with the intent to slow inflation, interest rates will rise on everything from credit cards to car loans, pressuring household budgets.

“All of this newfound debt that Americans have is only going to get more and more expensive in the coming months,” said Matt Schulz, chief credit analyst for Lending Tree.

The rise in debt levels is likely driven by two factors, Schulz said. First, there is some pent-up spending on the heels of the COVID-19 pandemic and stay-at-home orders from 2020. People in Springfield and the rest of the country wanted to get out, take trips, have new experiences with family and friends, and make purchases on items they were saving for. Then there are cash-strapped people who are turning to credit cards to pay for basic needs that have grown more expensive, he said.

“An increase in credit card debt can be a sign of confidence, or it can be a sign of concern,” Schulz said. “I think we're seeing both of those simultaneously right now in this country, and it's just another example of how different people have been impacted in the wake of the pandemic.”