Springfield’s police and fire pension fund, which at one time posed a serious problem for the city, is now in a strong position. But work remains to ensure retirees are given their dues.

Tony Kelley, who serves as the administrative director of the Police Officers' and Firefighters' Retirement System, gave Springfield City Council members a status report Dec. 19 on the condition of the pension and strategies being implemented to ensure its solvency in the years ahead.

The update came as council members consider placing a new sales tax on the ballot, to become effective following the expiration of the retirement system’s biggest source of revenue — the ¾-cent Pension Sales Tax.

“While the state of the system is truly a success story, it should not be taken as ‘mission accomplished,’” Kelley said.

State of the system, then and now

In 2006, the pension system closed to new hires, redirecting newly employed police and firefighters into the state’s larger Local Area Government Employees Retirement System, known as LAGERS.

By 2009, the health of the Police Officers' and Firefighters' Retirement System had deteriorated. Only 35.5% funded and $200 million short, the pension threatened to bankrupt the city. To help solve the problem, a 1-cent pension sales tax was put on the ballot. It was voted down. Eight months later, a ¾-cent version of the tax with a five-year term passed with 55% percent of the vote. Support for the tax, for which all revenues are earmarked for the pension, grew upon renewal votes to 76.2% and 77.8% in 2014 and 2019, respectively.

Today, the retirement system is about 87% funded based on the market value of its assets, or 90.7% actuarially funded.

“The community has made great strides in improving the health of the system since the sales tax was enacted,” Kelley said. “When looking at the market value of assets, the system has improved from a 30 to 40% market value of assets to nearly 90% market value.”

Reaching 100% — and staying there — will require continued contributions into the pension fund beyond hitting that mark, as investment returns fluctuate, pension members retire and, along with their dependents, eventually die.

As of June 30, there were 780 members in the pension system, down from 975 around 2009. Of the remaining members, Kelley estimated that just over 100 were active participants that would likely retire by 2030 to 2032.

Conservative strategy to protect assets

Similar to how individuals approaching retirement would lower the level of risk in their personal portfolio, the City Council is set to consider a new strategy to protect the long-term health of pension. Though proposing a shift to more conservative investments, Kelley said that the goal of a 6% rate of return will remain the same.

“So the types of investments that we have will become important as well, because you have to be able to liquidate some investments to pay benefits,” Kelley said, adding that this new approach will take between 7 to 10 years to fully implement.

Kelley said that this new strategy will come before council members in the coming months as an investment policy statement.

Though supported through four different funding sources, the Pension Sales Tax is by far the largest. A new sales tax of the same value would produce far more revenue — about $45 million annually — than what the pension needs.

In addition to tax revenue, the pension is supported by investment returns and employer and member contributions, as well as allocations totaling about $24 million made by the City Council in 2009 and 2010.

Retirements, new methodology to determine city’s contributions into pension

As the remaining crop of active participants retire, the employer contribution of 35% of its share of payroll will diminish. That contribution is estimated to be between $3 million to $6 million based on actuarial assumptions, and will need to be made with or without a new sales tax to help the pension reach 100% funding. About $88 million in liabilities is not yet funded in the pension.

Council members have emphasized the need for a new sales tax to continue to fund the pension, and expressed concern over the impact $3 million to $6 million in employer contributions could have on the city’s general fund if a new revenue source isn’t approved by voters.

Kelley said that the remaining 15 months of the Pension Sales Tax, which is set to expire on March 31, 2025, would “theoretically” help close in on 100%, but that economic conditions provided uncertainty for the pension’s investments and tax revenues.

“We all know with what's going on in the world right now that no one has that crystal ball and can see if that's really going to truly happen or not — that's what we're hoping,” he said. “Ideal scenario is that happens and then the new annual required contribution would be less because basically all the unfunded liability would be met.”

The Police Officers' and FireFighters’ Retirement System Board recently changed the methodology to determine that annual contribution in an effort to reduce volatility.

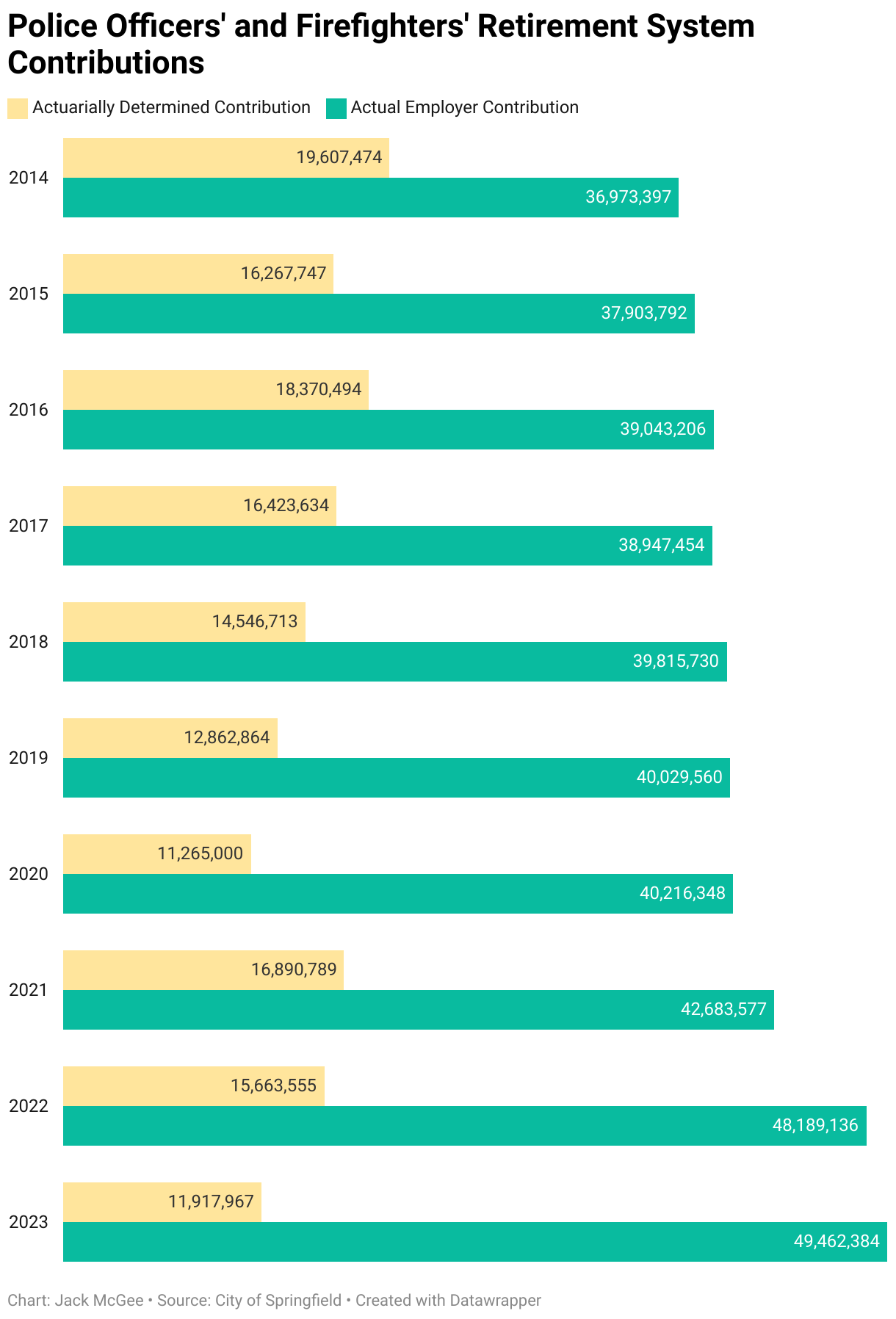

In 2023, the actuarially determined contribution was $11.9 million, but the actual employer contributions exceeded $49 million thanks to the Pension Sales Tax, which amounted to $44.5 million in revenue in Fiscal Year 2023. While it has fluctuated, the actuarially determined contribution was decreased over time while the actual contribution has increased.

Kelley emphasized that despite their projections, it is difficult to determine the contributions needed to help fully fund the pension, as it can vary from year to year.

“I'm not sure that I can give you a specific number that says if you put this amount in, everything's gonna be okay,” he said.