Most business leaders in Missouri claim the difficulties parents face finding available and affordable child care hurts their ability to recruit and retain workers, according to the Missouri Chamber of Commerce and Industry.

Loss of work at the expense of child care comes at an estimated cost of $1.35 billion annually for the Missouri economy and $280 million a year in lost tax revenue.

Legislation aimed at alleviating the child care problem is making its way through the Missouri House of Representatives.

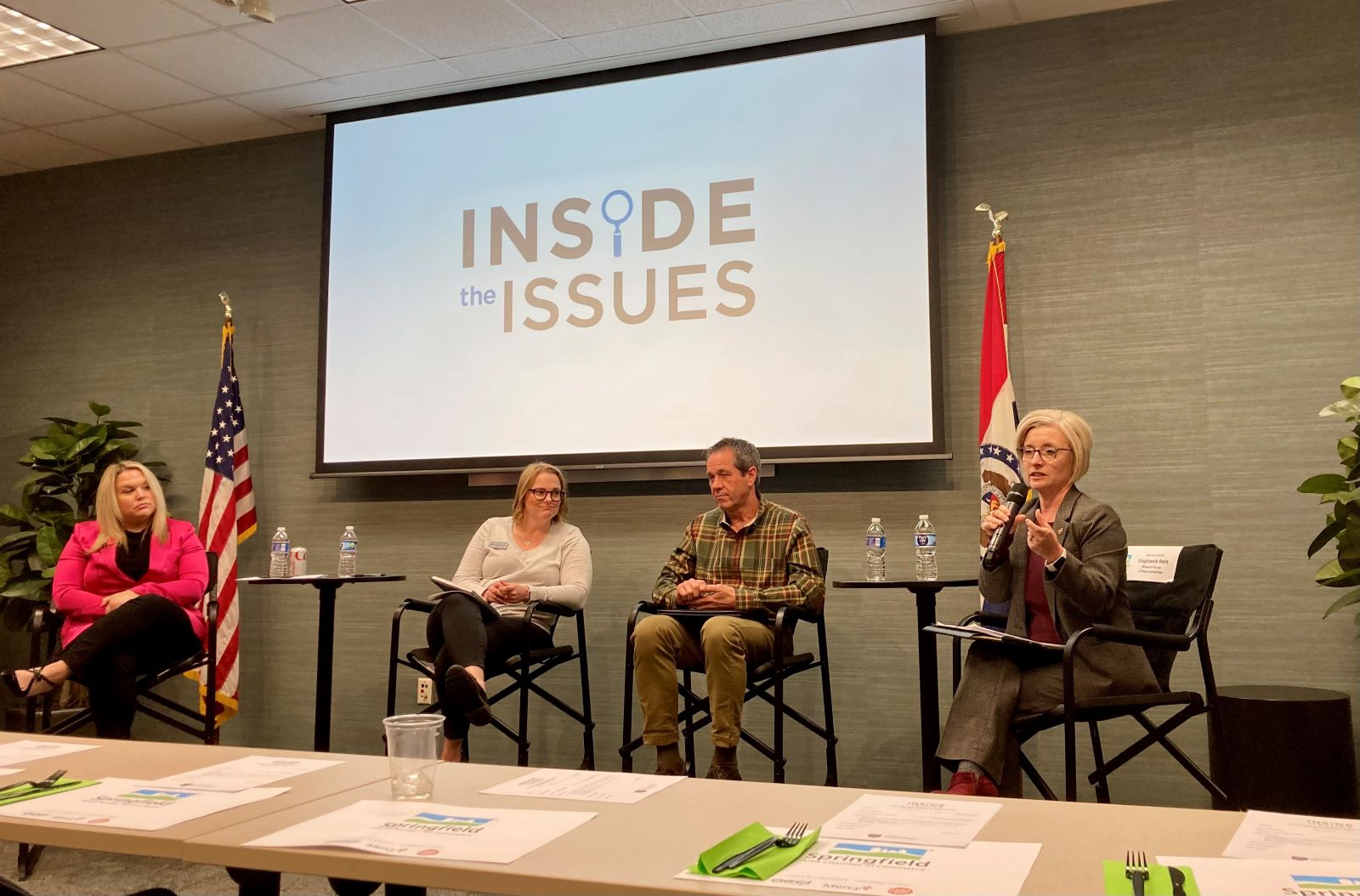

House Bill 1488, a comprehensive child care tax credit package, was among the topics discussed at Springfield Area Chamber of Commerce’s first “Inside the Issues” meeting Jan. 11.

Kara Corches, vice president of Governmental Affairs for the Missouri Chamber of Commerce, moderated the panel discussion and shared details about how HB 1488 could help.

Child care reform has bipartisan support

“This is a super complicated issue,” Corches said. “The silver lining is this issue has wide bipartisan support.

“It’s an issue that transcends party lines,” she said, adding that she has a 3-year-old and paid $21,000 last year for child care. “And I’m lucky I can find a spot.”

In her presentation, Corches outlined what most agree is the root of the problem: parents can't afford to pay for the true cost of child care and teachers generally make low wages with few benefits.

Joining Corches on the panel were Jennifer Crouch, director of the Early Childhood Education Center at Ozarks Technical Community College; State Rep. Stephanie Hein, D-Springfield, and Darrel Hopkins, president of Prime, Inc.

Crouch spoke about the difficulties child care providers have recruiting teachers willing to work for low wages doing extremely difficult and labor-intensive jobs.

“It’s no longer a working business model,” Crouch said.

Crouch referred to the child care crisis as a “two-prong issue” in that it impacts the current workforce and the future workforce.

In Crouch’s view, there’s been a significant increase in awareness about this issue since the height of the COVID-19 pandemic.

Trucking company offers on-site child care for employees

Hopkins, who’s been with Prime for 29 years and was recently named the trucking company’s president, talked about the Prime Kids Learning Center, an on-site child care facility for Prime employees.

Prime, Inc.’s goal is to hire top talent, Hopkins said, and a big part of that is offering great benefits such as child care. Prime also has an on-site fitness center, a doctor, chiropractor, hair salon and dry cleaner.

“It’s a little city within a city,” Hopkins said. Having those types of on-site facilities for employees cuts down on time they’d have to spend driving here and there. That allows employees to be more productive and earn more money, while having more time to spend with their families, Hopkins said.

He also spoke about how much parents appreciate being able to stop by the child care center and see their children.

“It’s a great retention tool,” Hopkins said. “That associate is not ever going to leave us, at least not until that child is in school.”

Hein, who represents the 136th Missouri House District, which includes much of southeast Springfield, is a former faculty member at Missouri State University. Hein shared about how often she spoke with female students who were concerned about being able to build their careers and also start families.

“We have to solve this issue if we want to keep our economy growing and our families growing,” Hein said.

“Reach out to legislators,” Hein said to those in attendance, “and make sure they know this is important to you.”

About HB 1488, the child care tax credit package

According to information from Gov. Mike Parson’s office, HB 1488 would provide three types of tax credits:

- Child Care Contribution Tax Credit: a tax credit for corporations, charitable organizations, individuals and partnerships for 75% of a verified contribution to a licensed or registered child care facility to promote child care, including for the acquisition or improvement of facilities, equipment, or services, including the staff salaries, training, or the improvement of the quality of child care.

Examples: A business contributes $10,000 to a child care provider towards the cost of care for its employees’ children. That business is eligible for a tax credit of $7,500. If a Missouri resident donates $1,000 to a local child care provider — as long as their child isn’t in their care — that resident is eligible for a $750 tax credit.

- Employer-Provided Child Care Assistance Tax Credit: A tax credit for employers’ eligible child care assistance expenditures. The tax credit is for 30% of child care expenditures.

Examples: A hospital pays a nearby child care provider for 30 slots on an ongoing basis to ensure its employees have access to a nearby child care facility. That hospital is eligible for a tax credit of 30% of its contract costs, up to $200,000 per year. A private college could set up its own child care facility on campus for students and staff. That college would be eligible for a tax credit of 30% of its costs associated with the child care program, up to $200,000 per tax year.

- Child Care Providers Tax Credit: A tax credit for child care providers’ eligible payroll tax withholdings for employees who work at least 10 hours a week for at least a three-month period (provider must have at least three employees) and up to 30% of eligible capital improvements to their facility.

Example: A child care facility makes $15,500 in capital improvements to add another classroom and expand the number of children served. If this facility also has at least three employees working more than 10 hours per week, that provider is eligible for a tax credit of $4,650 plus the cost of the employer’s tax withholdings for payroll for those three employees, up to $200,000.

Read more about the child care crisis here.